The Florida House of Representatives has passed legislation on vehicle inspection bonds that will most notably increase the bond amount. Effective July 1, 2015, private rebuilt vehicle inspection facility owners in Florida have to provide the Department of Motor Vehicles for their county with a bond rider to the current vehicle inspection bond that reflects the changes to the bond policy.

The major changes to this bond are as follows, according to the Senate amendment:

- The bond amount is increased from $50,000 to $100,000

- The policy in this bond applies to Miami-Dade County only and no longer to Hillsborough County

- The motor vehicle inspection facility should only provide rebuilt inspection services

- The facility operator must not have ownership interest in or other financial arrangements with any of the following:

- owner, operator, or employee of a motor vehicle repair shop

- a motor vehicle dealer

- a towing company

- vehicle storage company, vehicle auction, insurance company, salvage yard, metal retailer or metal rebuilder

- Records of each rebuilt vehicle inspection processed at a facility must be maintained for at least 5 years

- Any facility operator shall be immediately terminated from the program who doesn’t meet minimum eligibility requirements

- Before there can be a change in ownership, the current operator must give 45 days written notice of intended sale, and the prospective owner must meet eligibility requirements and execute a new memorandum of understanding with the department before operating a facility

The expiration date on the bond does not change. When the time comes for a facility owner to renew their bond, they will need to provide a continuation certificate or a new bond to cover the bond amount for the following year.

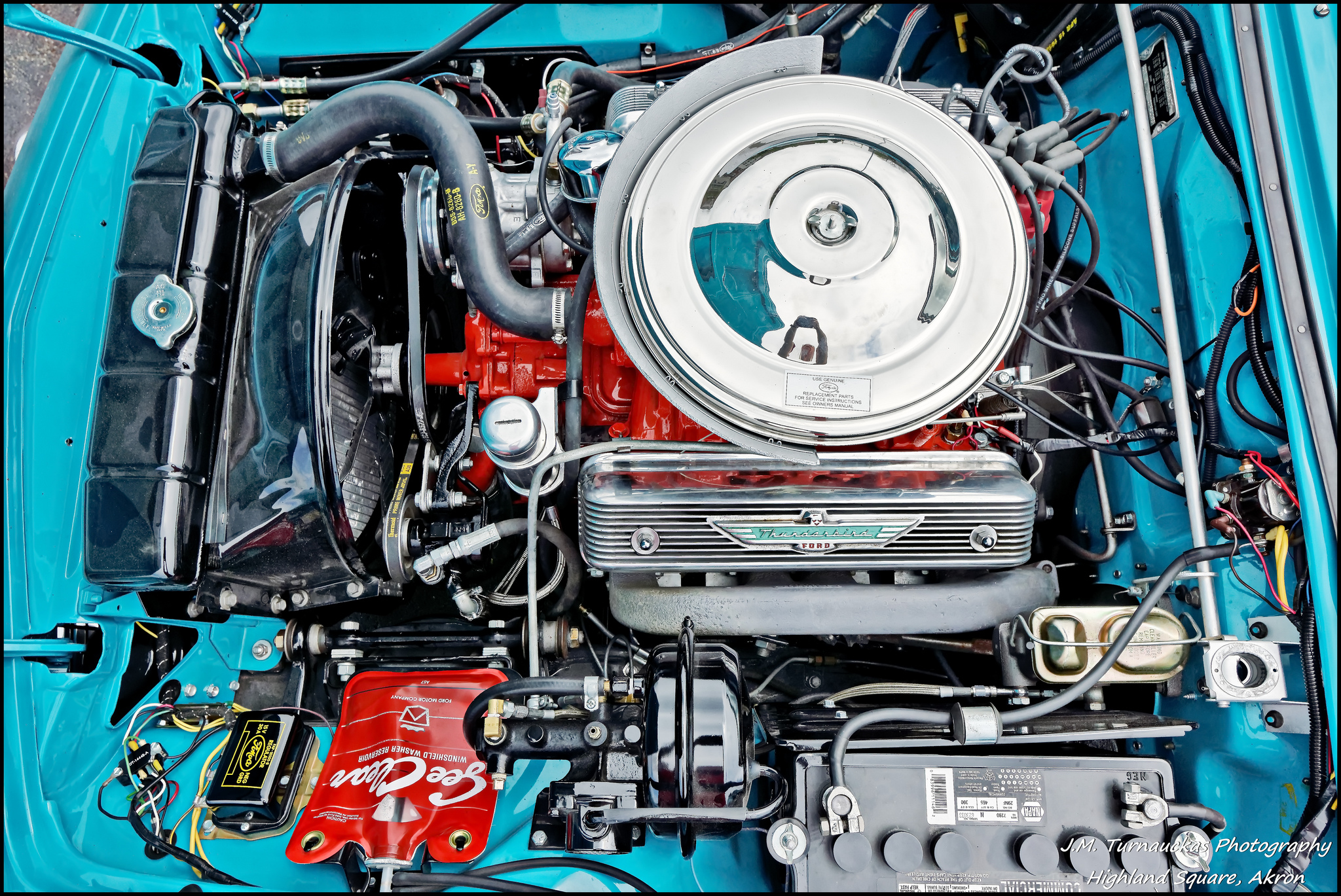

Photo by Mark Turnauckas (CC BY 2.0)