What motivates entrepreneurs to start a business?

Taking advantage of the factors that motivated you to start your business can help you deal with the unavoidable risks of entrepreneurship. Whether the risk is external and out of your control or internal and manageable, being able to operate outside of your comfort zone is a crucial component of turning your entrepreneurial motivations into a thriving business.

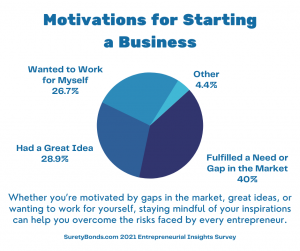

Some motivations can aid in overcoming specific risks of starting a business. Forty percent of the entrepreneurs surveyed in SuretyBonds.com’s 2021 Entrepreneurial Insights Survey responded that filling a gap in the market was their primary motivation for starting a business. In a Guide on Risk Management for a Small Business, the Small Business Administration notes the importance of addressing competition in risk control management and implementation. If you’ve identified an area of the market in which you have a competitive edge, keeping up with potential competitors may help you make sure you’re mitigating the risks of losing that edge.

Other entrepreneurial motivations such as great ideas and wanting to work for yourself should be kept in mind during difficult risk management processes. Embracing the uncertainties, fear, and discomfort that small businesses face, while necessary, is not easy; staying mindful of the reasons you started can keep you motivated to grow your business as you work to manage the associated risks.

One-third of entrepreneurs are hindered by attracting customers

While one-third of entrepreneurs surveyed by SuretyBonds.com responded that attracting customers was the largest obstacle in the creation of their businesses, figuring out how to build a customer base is an issue faced by almost all entrepreneurs. Certain hardships of attracting customers are unique to specific industries, but many are shared across the board.

Optimizing pricing, customer services, marketing research, and other tactics to retain previous customers and attract new ones is easier said than done. Here are what some of those respondents had to say about attracting customers:

Of those who encountered trouble with capital, 100% experienced it with obtaining funding

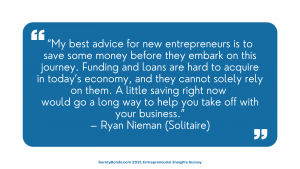

Our findings show that accessing capital and finding funding is one of the pain points entrepreneurs and small businesses face, regardless of the quality of their business. Many of those surveyed stressed this difficulty:

The Small Business Administration provides a guide to funding your business that begins with calculating your startup costs before outlining some of the funding options available to entrepreneurs, including:

- Self-funding (aka bootstrapping): Relying on family/friends, savings accounts, or your 401(k) for funding means more individual risk, but also more control over your business.

- Crowdfunding: Crowdfunders, unlike investors, typically receive the product you’re selling or other perks instead of shares of company ownership or financial returns.

- Venture capital: As the SBA notes, obtaining funding through venture capital typically follows the basic steps of finding an investor, sharing your business plan, going through a due diligence review, working out terms, and getting an investment.

- Small Business Loans: Having a business plan, expense sheet, and financial projections can increase your chances of securing a small business loan.

- SBA-Guaranteed Loans: SBA-guaranteed loans (found through Lender Match) are an alternative to traditional business loans.

The way you go about funding has large effects on your business, so it is important to identify the financing option that best suits your business’s needs and goals.

Which resources have been the most helpful in overcoming obstacles?

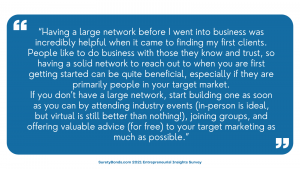

Seventy-one percent of those SuretyBonds.com surveyed responded that the most helpful resource to overcoming the obstacles of small business ownership was other entrepreneurs. The importance of relying on other entrepreneurs as a means of educating yourself on industries and decreasing learning curves was stressed in the 2021 Entrepreneurial Insights preview posts. In one post, Clare Tries of Clash Copy offered advice on network-building as a resource:

Another preview post on small businesses overcoming bad advice proposed other ways to build a network and gain entrepreneurial expertise, including:

- Finding a mentor

- Entrepreneurship meetups

- Startup weekends

- Chambers of Commerce or local business partnerships

- Startup accelerators like Y Combinator and Techstars

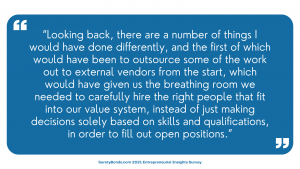

While other entrepreneurs were the most helpful resource for many of those surveyed, 17.4% responded that vendors and financial planners/accountants were the asset that had been most helpful to them. Many, such as Eden Cheng of PeopleFinderFree, noted necessary outsourcing of processes such as accounting in reflecting on things they might have done differently in starting their businesses:

For more information on the benefits of outsourcing, visit our preview post on How New Businesses Access Expertise.

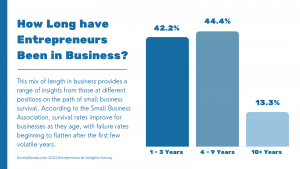

How long have the entrepreneurs surveyed been in business?

While 42.2% of those surveyed responded that they have been in business 1-3 years, and 13.3% said they’ve been in business 10+ years, the majority of those surveyed by SuretyBonds.com responded that they have been in business 4-9 years. This mix provides a range of insights from those at different positions on the path of small business survival. According to the Small Business Association, survival rates improve for businesses as they age, with failure rates beginning to flatten after the first few volatile years.

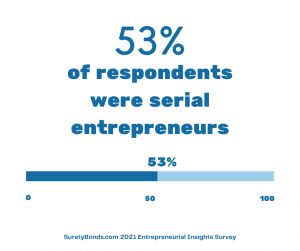

53% of entrepreneurs surveyed launched other businesses in addition to their first

In 2014, Stanford Professor Kathryn Shaw conducted research that lends credence to the idea that entrepreneurs are made rather than born. The research showed that experienced entrepreneurs, even those whose experience had come in the form of previous, failed businesses, increased their odds of survival and success. This is even true of entrepreneurs whose multiple ventures include projects in different industries.

Serial entrepreneurship is complicated, with expertise, networking, and advice being more crucial than ever. By launching multiple businesses, you’re putting yourself in control of multiple, diversified assets rather than relying on traditional methods that are based on the market forces outside of your control. While launching multiple business ventures can be a tool for gaining experience and finding success, you should also be mindful of the risks and sacrifices associated with serial entrepreneurship.

Of course, the experience of launching a business also shed light for these entrepreneurs on what they could have done differently. No business is launched without a mistake or two, but some business owners had specific recommendations they would pass along to other aspiring entrepreneurs.

In summary, SuretyBonds.com’s 2021 Entrepreneurial Insights Survey respondents “went for it” in a challenging and unpredictable market. Each, however, found the experience rewarding and motivating. While things may not have always gone as planned, each entrepreneur reported feeling more prepared for what’s to come — the goal of every person running a business.

SuretyBonds.com is proud to have helped numerous entrepreneurs launch this year, and we look forward to supporting them in the year to come. If your entrepreneurial dreams require getting bonded, please call 1 (800) 308-4358 to talk to a SuretyBonds.com surety professional today. Together, we can accomplish great things.