High Risk

Secure | No Obligation | Takes 2 Minutes

High Risk Surety Bonds

For years, companies and individuals lacking strong financial credentials struggled to obtain the surety bonds required by government agencies. Over time, a new market emerged to cater to these applicants.

Today, a handful of surety carriers offer high-risk surety bonds for those who don’t meet the standard market prerequisites needed for surety bonds. This flexibility allows applicants with less-than-stellar credit to secure the bonds they need to run their businesses.

What is ‘risk’ in terms of the surety process?

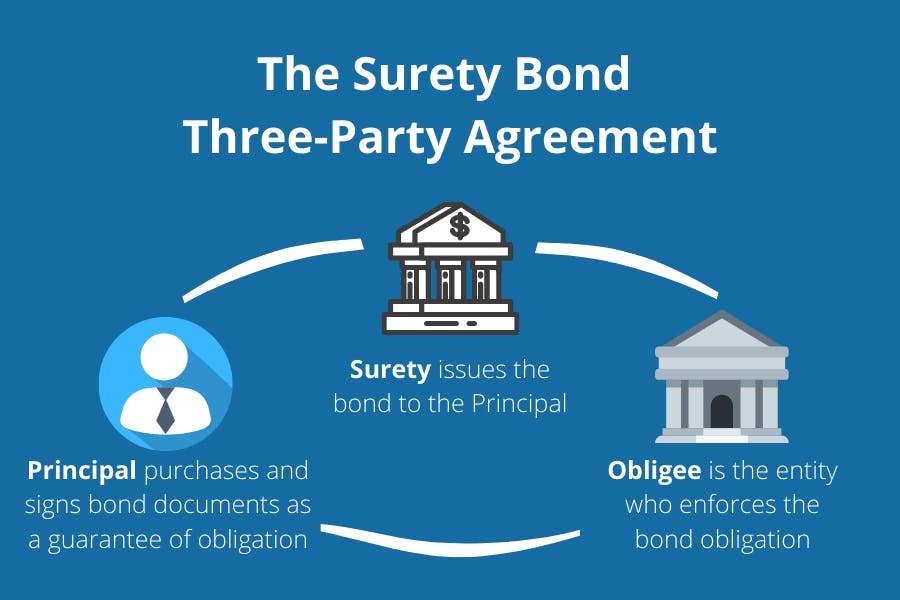

A surety bond is a financial guarantee of the principal’s ability to meet the bond’s terms. When a surety provider issues a bond, it is providing this guarantee.

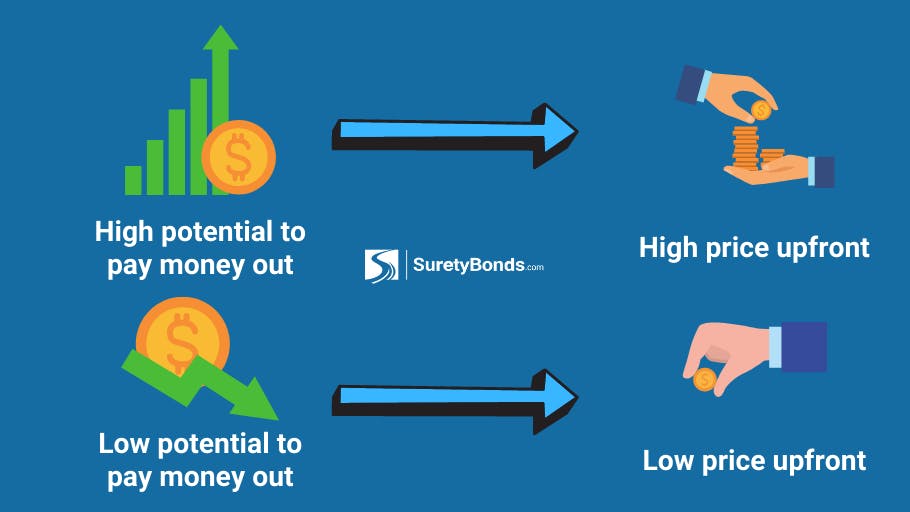

Risk is the possibility of financial loss due to potentially negligent or damaging actions on the part of the principal. The risk associated with the surety process is based on the chances of a claim being filed against the principal. The lower the risk, the lower the rate.

What determines the risk of a surety bond?

CLAIM HISTORY OF BOND

Some professions, such as telemarketers or mortgage brokers, receive a higher number of claims. This history of claims increases the chances that another will be filed, thus increasing the risk. However, with a more stable industry — such as public adjusting — there is very little to no history of claims; therefore, there is a lower risk associated with this industry.

AMOUNT OF BOND

The bond amount also plays a significant role in the risk of said bond. As one might guess, a $1,000 sign contractor bond poses a lot less risk to a surety than a $20,000 roofing contractor bond. Because a surety will pay out up to the full amount of the bond, the higher the bond amount is, the higher the potential payout. A larger bond amount means the surety is opening itself up to much more significant liability if a claim were filed.

Underwriting a risky bond

Surety underwriting is a process performed by a qualified expert, known as an underwriter, to determine whether a bond can be issued and how much an applicant will pay for the bond. The underwriting process is used when a bond is deemed “risky” by the surety company. There are multiple factors that an underwriter will take into consideration when reviewing an applicant. By reviewing all of this information before providing a quote, the underwriter is able to adequately assess the risk involved with writing the bond.

What does an underwriter look for when quoting a risky bond?

All surety bonds are either issued instantly at a set premium for every applicant or subject to review by an underwriter. If underwritten, the cost will be calculated based on the type of bond application and the applicant’s financial history.

BOND APPLICANTS

When determining the rate of a credit-based bond, underwriters must examine each principal listed on the application. You may be wondering who can — and should — be listed on your bond. Luckily, this is fairly straightforward: Any person who owns 10% or more of the business must be listed as a principal. Anyone who owns less than 10% can be listed, but it is not necessary. The only time someone absolutely cannot be a principal on the bond is if they have zero ownership of the business.

FINANCIAL HISTORY

Business

When applying for a bond, underwriters will want to know whether you’ve had any previous business ownership or experience. Having a history that shows you worked at or owned a business in the same industry can sometimes offer the surety assurance that you have adequate experience to keep a business going. On the flip side, if there is a suspicious history of closing businesses and reopening under a new name, excessive debt, or other activity of the like, this could be a reason for non-approval.

Personal

One of the first things an underwriter will look at is the credit report of the applicant. Of course, there are many factors that can affect a credit score: credit cards, student loans, hospital bills, bankruptcies. This is where the underwriting process can get a bit messy.

With so many factors at play, each and every customer has a unique history that must be taken into account. Work history, liens, real estate (including whether you are a renter or have any paid-off mortgages), and so much more can impact how risky an applicant you’re deemed to be.

In the case that an underwriter requires more information than what is reported by the credit bureau, additional personal financial documents may be requested. If this is the case, we commonly recommend having an income statement and balance sheet for the most recent fiscal year prepared.

High-risk surety bond collateral

Some surety providers require applicants to post collateral in addition to paying their bond premiums. Whereas insurance providers expect claims to be made on policies, surety providers try to avoid any possible claims.

Because surety providers don’t consider financial losses when writing their premiums, they must ensure that principals have the financial means necessary to provide compensation if a claim should be made on a high-risk surety bond. These high-risk bonds can require cash collateral equal to the full penal sum or an irrevocable letter of credit from your bank.

What if I’m unhappy with my quote?

One of the advantages of working with SuretyBonds.com is that we shop around for the lowest possible price for you. In recent years, surety providers have been able to offer special financing plans for people paying high premiums for their high-risk surety bonds.

The act of financing a bond, however, means that the overall cost of the bond increases in the long run. Although financing could be helpful for those who need high-risk surety bonds, these principals should recognize that it’s cheaper to pay bonds with one payment.

If you feel that financing might be the right decision for you, we recommend learning more about what to expect.