Surety underwriting is the review process performed by an underwriter to approve and quote bond applications. Underwriters review the bond coverage and applicant’s financial status to determine the risk level and their ability to reimburse potential claims.

Using these criteria, the surety underwriter will typically calculate a price quote of 0.5–10% of the total bond amount. Your exact rate will depend on your credit history and other application materials.

*Note: Not all bonds require underwriting before filing.

How Does the Surety Underwriting Process Work?

The typical process for surety underwriting follows these three steps:

- Submit your surety bond application and any applicable documentation.

- A surety underwriter will evaluate your application materials to determine risk.

- An account manager will contact you with a quote and next steps.

Underwriters look for terms on the bond form that can affect the principal’s performance or the nature of the surety’s guarantee. For example, many bonds have language capping the aggregate limit of claims at the bond amount.

However, certain bonds omit this language. This creates greater risk for the surety because they can be liable for an amount greater than the bond coverage.

How Long Does the Underwriting Process Take?

The underwriting process can take anywhere from a few minutes to several days. If you apply between 8 AM to 4 PM Monday–Friday, SuretyBonds.com will typically process your application same-day. However, the underwriting process can take longer for certain bond types, such as performance and payment bonds.

Our responsive Customer Care Team will provide updates as your application is being reviewed for any issues or delays.

Why Do Surety Companies Underwrite Bonds?

Surety companies underwrite bonds to minimize claims and weed out high-risk applicants. In surety underwriting, risk is the possibility of financial loss if a bond claim is filed and the principal is unable to repay the surety. This is why large bond amounts and inherently risky bond types almost always require underwriting review.

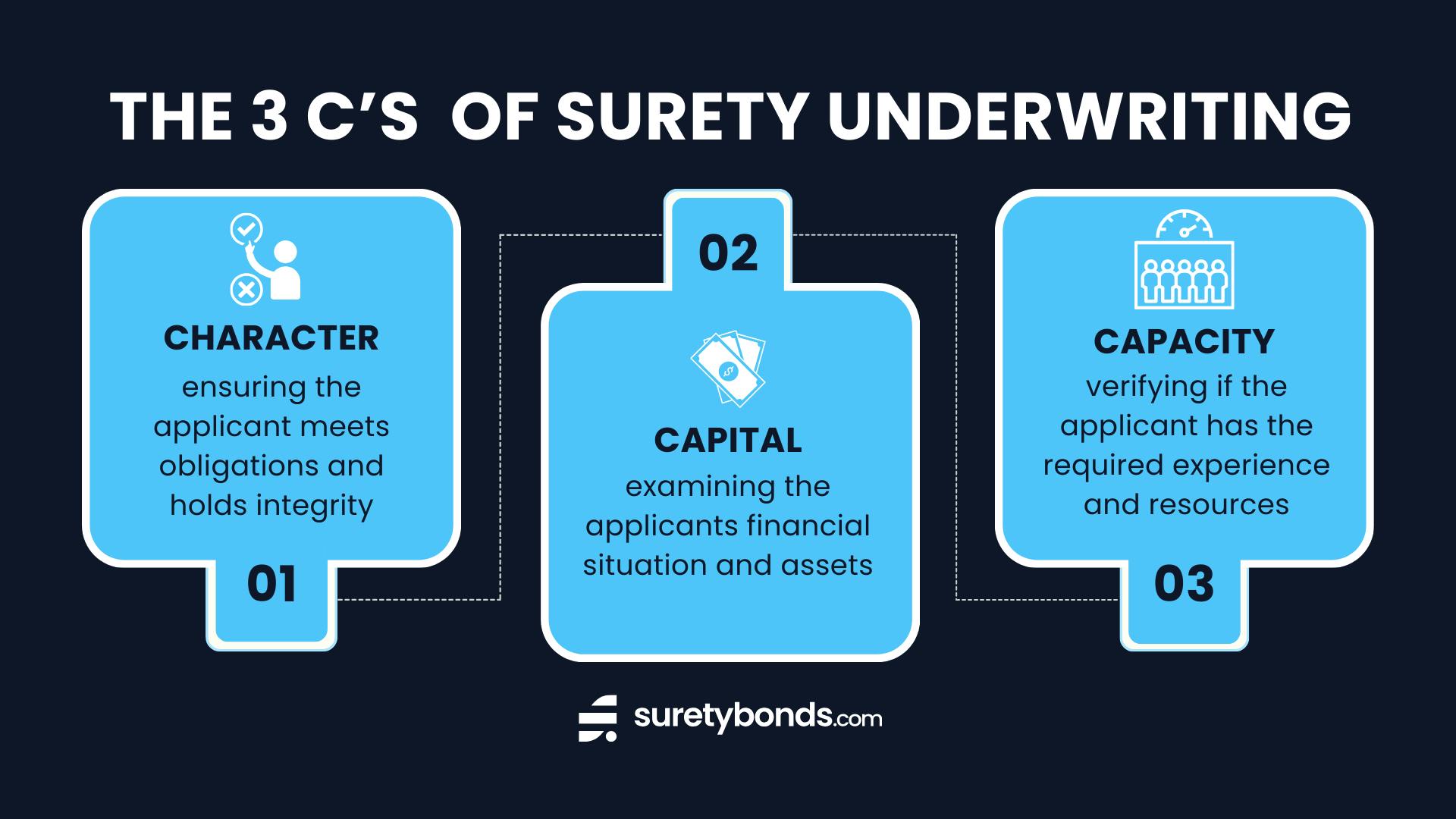

What Are the 3 C’s of Surety Underwriting?

The three C’s of surety underwriting are the additional factors that underwriters look for in a bond application: character, capacity and capital:

- Character looks at the applicant’s integrity and ability to meet bond obligations. This can include a history of making payments on time, personal references and a clear legal record.

- Capacity refers to whether an applicant has the proper experience and financial ability to fulfill the bond contract. This is where an underwriter looks at industry expertise, education, work history, personnel and even machinery.

- Capital examines the financial health of the applicant in relation to the bond amount. This includes personal credit history, business financials, owned assets and overall net worth.

What If My Bond Application Is Denied?

If a surety company denies your bond application or provides a high premium quote, they should provide specific reasoning. You can dispute the quote or denial by providing proof of updated information.

Acceptable proof includes the following:

- Cash verification

- Screenshots of bank accounts

- Bills paid

- Collections removed

- Liens removed

Factors leading to bond denial might be fixable or permanent and outcomes vary by case. Proof of updated information could lead to a reconsideration of denial, a lower premium or simply the original response.

What Can Cause My Bond Application to be Denied?

Your application is more likely to be denied if you have a history of the following:

- Bankruptcy declarations

- Lawsuits

- Tax liens

- Missing payments

- High volume of debts

- License suspensions

An underwriter can decide that falling behind on a loan payment doesn’t warrant denial, but the premium may be higher to account for the greater risk. This premium increase can also happen to applicants with poor credit, a high-risk bond or a large bond amount.

What’s the Difference Between Surety Underwriting and Insurance Underwriting?

Insurance underwriting evaluates the risk of insuring people, businesses or objects to determine if the insurance company should provide coverage. You pay a premium to cover yourself if a loss occurs. The premium is calculated based on expected losses sustained by the insurance company for claims settlements.

Surety underwriting determines whether a surety will extend a line of credit to a principal and at what cost. The premium is based on the likelihood of a claim being made against the bond and the applicant’s ability to reimburse the surety. Sureties underwrite bonds with the assumption that the policy won’t be used.

Visit our Surety Bond vs. Insurance page for more information.