At SuretyBonds.com, we believe everyone should have the opportunity to get the surety bonds they need. With our bad credit surety bond program, we approve 99% of applicants regardless of credit status or financial history.

Continue reading to learn how you can get a surety bond with bad credit.

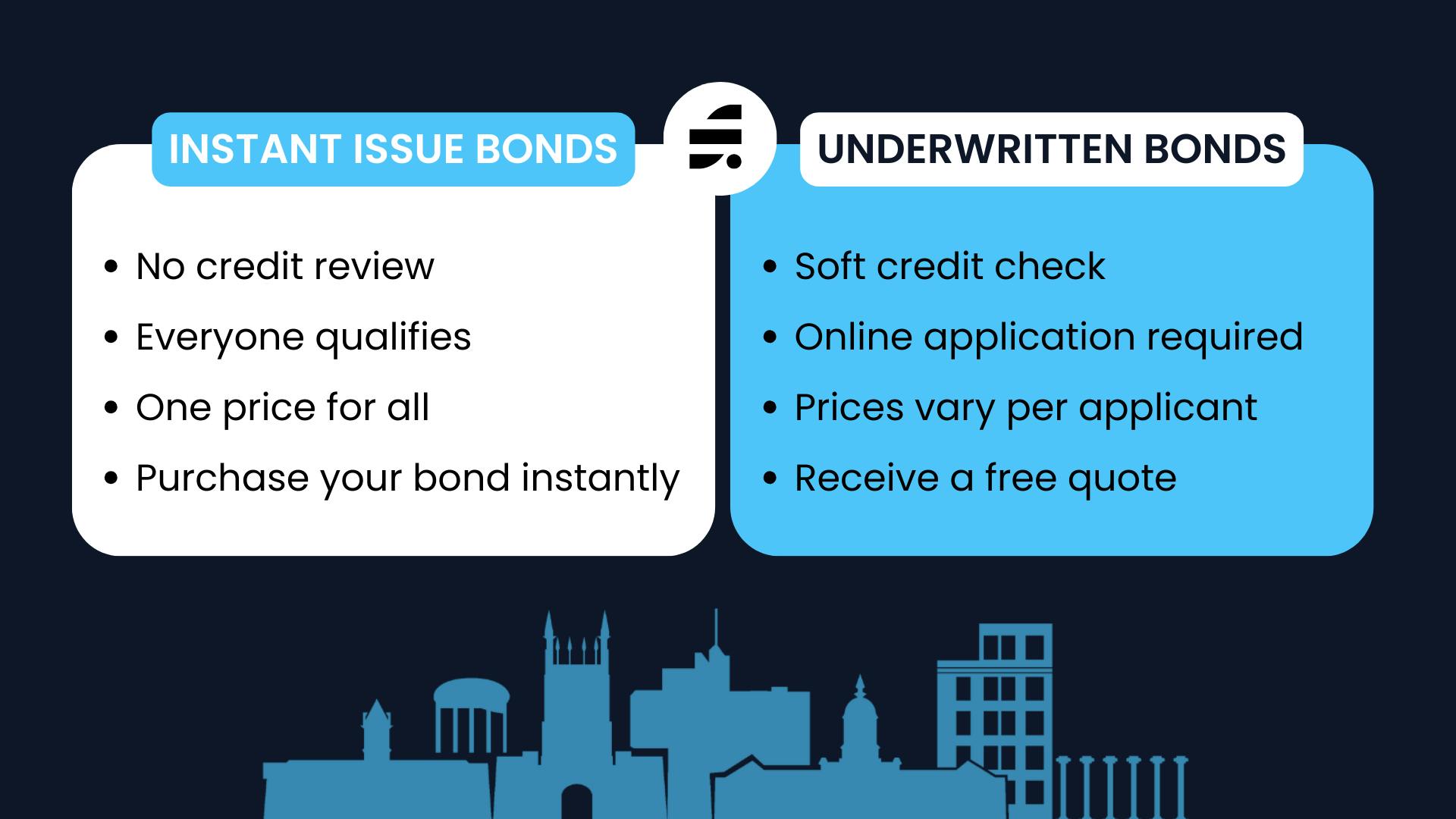

Understanding Instant Issue vs Underwritten Bonds

To begin, it’s helpful to understand the difference between bonds that do and don’t require a credit check.

Instant Issue Bonds: No Credit Check

- If your bond is available for instant purchase, you can get bonded regardless of credit score.

- Instant issue bonds are the same price for all applicants. Since there’s no underwriting process, you are automatically approved.

Underwritten Bonds: Soft Credit Check

- If your bond requires underwriting, you’ll need to fill out a quote application before purchasing.

- Typically, a soft credit check determines your price rate and whether you need to provide any supporting documents before being approved.

Qualifying for High-Risk Bonds

When a bond is considered "risky", the surety underwriting process determines if you qualify and, if so, how much you will pay for the high-risk bond. In the surety process, risk is determined based on the chances of a claim being filed on the bond.

Because of this, credit score is not always the only factor in calculating bond risk and premium rates. Other factors that make some bond applications risky or not include the following:

- The nature of the industry/type of work

- The applicant's personal financials (credit score, liens, debts, net worth, tangible assets)

- The applicant's business financials

- How much business or industry experience the applicants have

- How the bond form is written (claims process, clauses, etc.)

Which Bonds Are Considered High Risk?

Some of the most high-risk bond types include court bonds, freight broker bonds and performance bonds. For example, performance bonds are inherently risky because they typically depend on a contractor's ability to complete a large-scale construction project properly.

To qualify for these higher-risk bond categories, you often do need a good to excellent credit rating.

What Credit Score Do I Need to Qualify for a Bond?

Poor credit won’t necessarily disqualify you for a bond. With our bad credit bonding options, SuretyBonds.com approves 99% of all applicants regardless of credit score.

However, results will vary based on the available surety markets as well as your specific bond type. For example, contractors need a 700+ credit score for most construction bonds.

If you are a contractor struggling to qualify for a performance or payment bond, SuretyBonds.com is an SBA-approved vendor. That means we can help you explore bad credit construction bond options through the SBA Surety Bond Guarantee Program.

How Do I Get a Bad Credit Surety Bond?

We treat all applicants the same, regardless of credit history. In some cases, we may need extra information before we can approve your bond application.

To get bonded with bad credit, call 1 (800) 308-4358 to speak with one of our experts or fill out an online quote request form now.

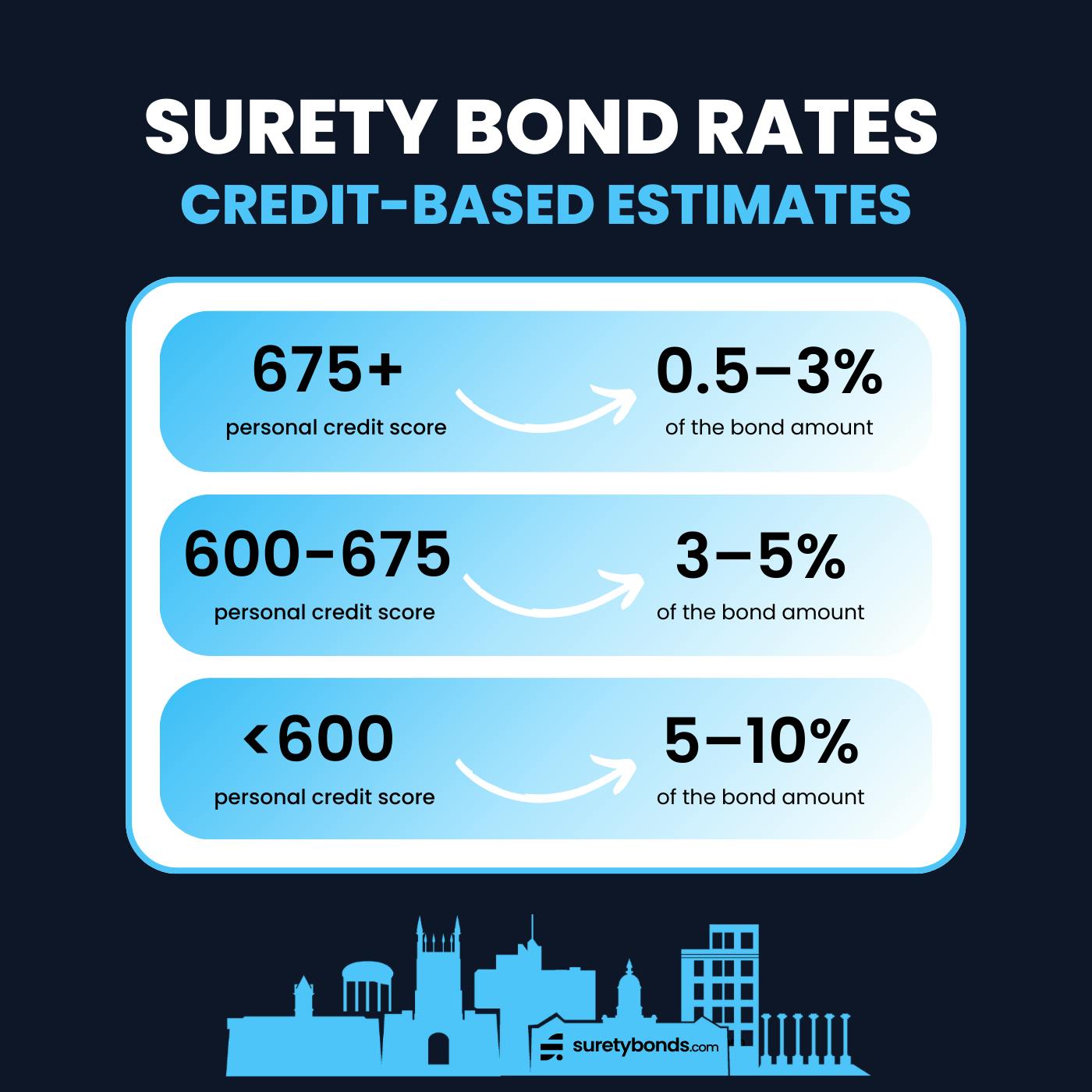

How Much Will My Bad Credit Bond Cost?

Poor credit can adversely affect your surety bond cost by indicating higher risk. However, we’ll work with the top sureties across the nation to match you with the best available price on the market.

An excellent credit score of 675+ will qualify you for the best market rates for the majority of bond types. This means you’ll pay 0.5–3% in most instances.

If your credit is average, rates tend to fluctuate between 3–5%, while poor credit bonds are often in the 5–10% price range.

Bad credit surety bond premiums vary greatly by bond type and location. Visit our Surety Bond Cost FAQ page to estimate your bond premium based on your credit score and bond coverage needs.

| Surety Bond Amount | Excellent Credit (675+) | Average Credit (600-675) | Poor Credit (599<) |

|---|---|---|---|

$25–$150 | $150–$250 | $250–$500 | |

$50–$300 | $300–$500 | $500–$1,000 | |

$125–$750 | $750–$1,250 | $1,250–$2,500 | |

$250–$1,500 | $1,500–$2,500 | $2,500–$5,000 | |

$375–$2,250 | $2,250–$3,750 | $3,750–$7,500 | |

$500–$3,000 | $3,000–$5,000 | $5,000–$10,000 | |

$2,500–$15,000 | $15,000–$25,000 | $25,000-$50,000 | |

$5,000–$30,000 | $30,000–$50,000 | $50,000–$100,000 | |

*This table provides rough bond cost estimates. Pricing fluctuates due to various factors. Apply online for an exact quote. | |||

Can I Finance a Bad Credit Bond?

If bad credit makes your bond premium unaffordable, a premium financing plan can break it up into more manageable payments over time. Learn more about which bonds qualify for premium financing.

Will My Surety Bond Cost Get Cheaper If My Credit Improves?

Yes, if your financial records significantly improve from your initial application, underwriters will review your bond and offer a lower premium if available.

Most bonds renew annually, giving you a chance to improve your rate during the renewal period every year.

What If Bad Credit Applicants Get Denied?

If you have very low credit, a history of bankruptcies, or outstanding payments on your financial records, your surety bond application could be denied.

Your surety company should provide justification for the decision, such as low credit, a criminal background, lack of industry experience, or a tarnished financial record.

In some instances, you can counter with additional financial information or proof of removed liens, collections, or debts.

Similarly, if you receive a high quote, you can try submitting more financial information to improve your rate.

High-Risk Surety Bond Collateral

In rare cases, surety companies that write large, high-risk bonds require require applicants to post collateral in addition to paying their bond premiums

Because surety providers don’t expect financial losses when they price bond premiums, they must ensure that principals can provide compensation if a claim is made on a high-risk surety bond.

For the riskiest bonds, a surety may require cash collateral equal to the full bond coverage or an irrevocable letter of credit from your bank.

Get Your Bond Quote

Ready to get your personalized quote? Just select your state, find your bond type, and get an absolutely free quote. It’s that simple!

If you prefer to speak to someone directly, our bond experts are available to help 7 am–7pm CST Monday through Friday.