The SuretyBonds.com Small Business Spotlight series focuses on small businesses across industries and the best practices that have helped them succeed.

After retiring from law enforcement, longtime friends Michael Corwin and Michael Verhoff went into business together to launch KC Mortgage Duo. Their vision is to assist local heroes in getting home loans.

The Challenges and Rewards of Starting a Business

Before partnering with Verhoff, Corwin had spent 30 years in law enforcement. Though he wanted to become a mechanical engineer when he was younger, he found himself enlisting in the Army to earn money for college. He spent some time in Europe as a surveyor before becoming a police officer in St. Joseph, Missouri. He took law enforcement classes and worked his way up to becoming a major in the Kansas City Police Department. When he wasn’t working, Corwin took classes and eventually obtained his master’s degree in business administration.

Once Corwin retired from law enforcement, he delved into a variety of work, from designing software to owning an international broadband business. He eventually sold the business and decided it was time to begin a mortgage company with his friend of 35 years. The two entrepreneurs share a long history, including serving in each other’s weddings. Verhoff also worked for the Kansas City Police Department before owning a prosthetics business. The two eventually started their mortgage business by registering the company name in 2020. It officially opened on November 1, 2021.

Though the company started during a pandemic, the pair haven’t let that get in the way of building their business. Primarily a virtual company, one limitation they faced was elderly customers occasionally having a difficult time obtaining a mortgage loan through a digital platform. Before the Omicron variant, Corwin would go to their homes to hand-deliver the required documents. He also makes sure to spend plenty of time communicating with and educating his clients. The company’s highest priority is to deliver excellent service and help its clients in the smartest way possible.

Advice for Entrepreneurs

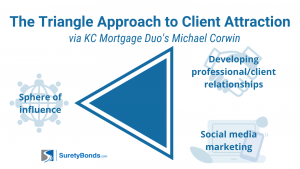

With the skills Corwin has developed over the past 30 years, finding KC Mortgage Duo’s first clients wasn’t as difficult as expected. He describes this process as the three points of a triangle, or a tripod. This balance not only serves the company, but also its customers.

First, he creates a sphere of influence for the company. Corwin set up all of the Google and marketing-related accounts for easy accessibility for potential clients. Most recently, KC Mortgage Duo purchased a billboard to advertise. Corwin also develops relationships with realtors, encouraging them to direct mortgage-seeking customers their way. Lastly, Corwin makes sure to have constantly updated social media accounts.

This shows audiences that the company is active and helping its customers. Corwin believes a business needs all three ideals to stand on its own. Without them, a business may not find the clients it’s hoping for or strike the right balance in focusing its attention. Corwin found that business is all about referrals; a company that builds strong relationships with its clients gains positive reviews and publicity. Corwin explained, “The relationship is stronger when we work with people and help guide them through this process.”

Navigating the Industry Landscape

While finding clients didn’t seem to be a difficult task, getting the company started involved a lengthy process. Using NMLS, the duo gained a loan originator license in every individual state the company operates in. The difficulty came in terms of each state having different requirements. In Kansas, KC Mortgage Duo had to have $50,000 in its bank account, with a CPA reviewing financials — regardless of the company’s age. While Missouri did not require the business to have a certain amount in its bank account, it did require the company to host a physical location and undergo a background/credit check. The company also needed to get a city license registered with the business’s name and a surety bond for every state served.

As this was his first time getting a bond, Corwin had no idea what to expect from the process. Starting with the Missouri bond, he went to SuretyBonds.com to purchase one. Describing it as a “painless and easy process,” Corwin knew exactly what to expect when buying a bond for Kansas.

KC Mortgage Duo anticipates its business growing; the pair expect to onboard more staff to meet the predicted increase in business for the next three to five years. KC Mortgage Duo is excited that its growth will be able to help even more of its “hometown heroes” finance homes.