SuretyBonds.com recently published a report detailing the findings of the 2021 Entrepreneurial Insights Survey, in which small business owners and entrepreneurs were asked about their motivations, obstacles they faced, and the resources that have been most helpful to them. The small business owners surveyed provided a range of insights, from those just starting their business journeys to serial entrepreneurs who have been in business for years.

The 2021 Entrepreneurial Insights Survey took stock of the incentives that lead entrepreneurs to start their businesses, with the majority responding that they found a gap in the market that they wanted to fill and others noting their great ideas or a desire to work for themselves. Among the survey’s other highlights, SuretyBonds.com found that a third of entrepreneurs are hindered by attracting customers and that 71% of the business owners surveyed relied on other entrepreneurs as a tool to their success.

See the SuretyBonds.com 2021 Entrepreneurial Insights Survey Report for the full findings.

Funding is a universal pain point for entrepreneurs

One topic referenced by many entrepreneurs in SuretyBonds.com’s survey was funding. Our findings show that accessing capital is one of the ubiquitous pain points faced by entrepreneurs and small businesses, regardless of the quality of their business. Of those who faced obstacles with capital, 100% experienced trouble with obtaining funding. Some, such as Clare Tries of Clash Copy, recommend small business owners look into funding their entrepreneurial projects with venture capital investments.

Others, like Ryan Nieman of Solitaire, offer advice on saving money: “Funding and loans are hard to acquire in today’s economy, and [new entrepreneurs] cannot solely rely on them. A little saving right now would go a long way to help you take off with your business.”

There are plenty of funding avenues for small businesses and entrepreneurs to pursue, all with their own sets of perks and potential pitfalls. It is important to identify the financing option that best suits your business’s needs and goals — the way you go about funding can have wide-ranging impacts on your business.

The 2021 Entrepreneurial Insights Report references the Small Business Administration’s guide to funding your business, which includes a startup cost calculator and some funding options. Here, we’ll dig a little deeper into the specific upsides and risks of different ways that entrepreneurs can fund their businesses.

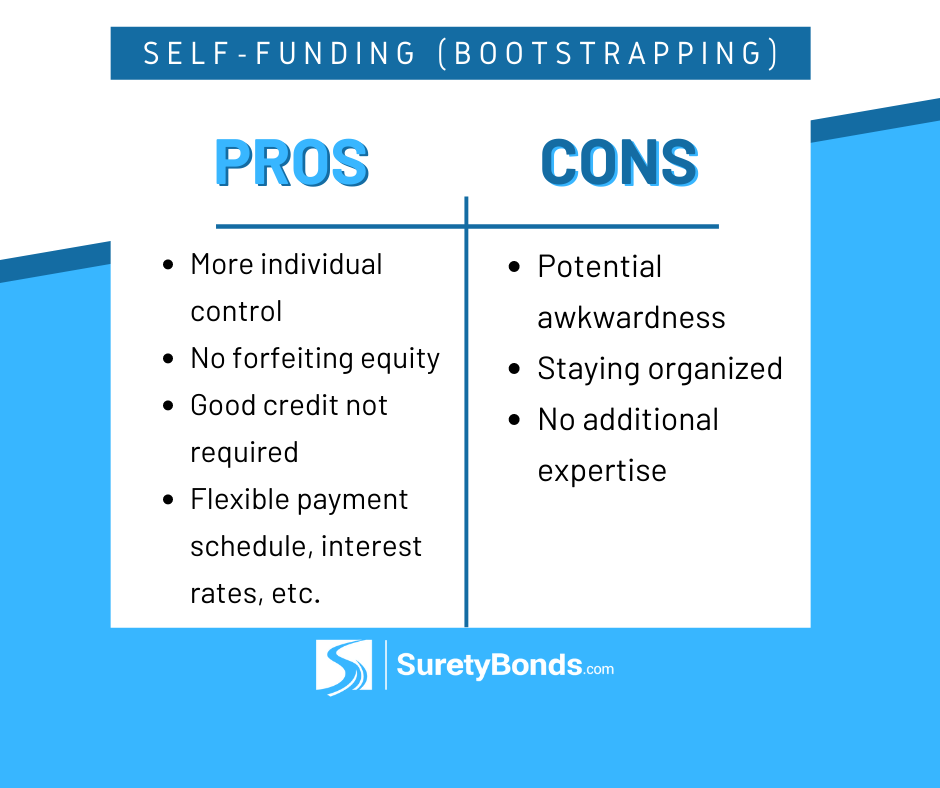

Self-funding (bootstrapping)

Perhaps one of the simplest ways to finance your entrepreneurial pursuits — relying on personal savings or loans from family or friends — can mean more individual control over your business, but it also comes with a unique set of risks. Typically, you would utilize bootstrapping methods in the pre-seed funding rounds, when your company is first beginning to operate and doesn’t yet have the infrastructure to court larger investors.

In 2021, Entrepreneur wrote about strategies for bootstrapping businesses. Among these tips was a reminder that successfully bootstrapped companies typically have business plans that are built to generate revenue quickly. Personally financed startups risk depleting their cash reserves before becoming established enough to bring in revenue. Maintaining negative cash conversion cycles and not spending more than necessary are also important goals to keep in mind. Financing operations using sales/suppliers instead of external money, vertically integrating to sell directly, and spending money where it counts to gain customers are essential for bootstrapping entrepreneurs.

Many of the perks of funding your small business without the help of larger institutions or organizations are self-evident. Obstacles to traditional funding routes, such as poor credit and high interest rates, may be more flexible in private arrangements, with extra willingness to accept grace periods or payment breaks. Taking a loan from someone you know may also allow for added lender advantages, as they may take on an investing or leadership role while watching their friend’s or family member’s business grow.

Obviously, orchestrating a lending agreement with someone you know is not so easy in practice and may get hairy without the clarity offered by traditional contracts. Even apart from the precarious nature of these types of arrangements, well-meaning lenders may be targeted by the International Revenue Service if proper loan documentation (including signed promissory notes and payment schedules) is not provided. Taking a loan from a friend or family member might seem like a way to bypass the red tape involved with traditional lending institutions, but misunderstandings and discrepancies may easily arise if the involved parties aren’t clear on the terms and conditions, including whether an investment comes with a role in the company’s operations and what happens when the borrower misses a payment.

Startup accelerators and entrepreneur-focused programs

Startup accelerators, which select groups of companies and offer advice and connections in return for a portion of those companies’ equity, have become a popular option for entrepreneurs. One of the areas in which startup accelerators can be most helpful, according to Wharton, is fundraising. Many accelerators offer meetups where entrepreneurs pitch their business ideas to many investors at once in order to find funding. Accelerators can also offer a signal to investors; having a high-level accelerator’s stamp of approval speaks to the legitimacy of your small business in the same way a degree from a prestigious university sends positive signals to employers. Being able to compare your business to similar businesses through accelerators may offer extra information that would not otherwise be available and provide a level of healthy competitive pressure.

While aid in finding funding may make startup accelerators an attractive avenue for budding entrepreneurs, they can also make operations difficult. For example, being involved with an accelerator often means weak relationships; attending many mandatory events, some of which may not be relevant or useful to your entrepreneurial needs and goals; and long programs. Giving up equity in your company may not be desirable for how you hope to build your business. Where your business is at and the direction you are hoping to take it should be factored into deciding whether a startup accelerator or entrepreneurial program is right for you.

Investors or investing groups

Venture capital investments differ from loans in that investors will expect equity and a say in your company’s decision-making in exchange for their capital. Typically, venture capital investments also have longer horizons than traditional financing methods. The money being yours to keep, the personal interest that investors have in your business’s success and growth, and the ability of venture capital funding to help get your business to the next level quickly might make venture capital a strong funding possibility if your business is ready to move into rounds of seed funding.

Here’s what Clare Tries has to say about the benefits of venture capital: “I would have looked into getting capital funding a lot sooner! This would have enabled me to grow my team and scale faster to serve more clients of a larger size.”

The Small Business Administration supplies an outline of the basic steps of the venture capital process, including:

-

Doing thorough research to find an investor

-

Sharing your business plan with the knowledge that firms and investors focus on specific industries, areas, and stages of development

-

Going through a due diligence review of your team’s management, products, documents, and finances

-

Working out terms of the investment

-

Acquiring the investment and integrating the venture fund into your company

Of course, the level of control that you will forfeit in your company (sometimes a majority stake) and the stage that your company is at are factors you should consider. Many startups scale prematurely and fail due to things like acquiring an unmanageable number of customers or overstaffing. If you don’t need additional expertise, aren’t ready to grow, or prefer to control operations yourself, other seed-funding avenues may be preferable. Brex provides a useful guide of some rough parameters that will help you decide whether your business is in its pre-seed or seed-funding stages.

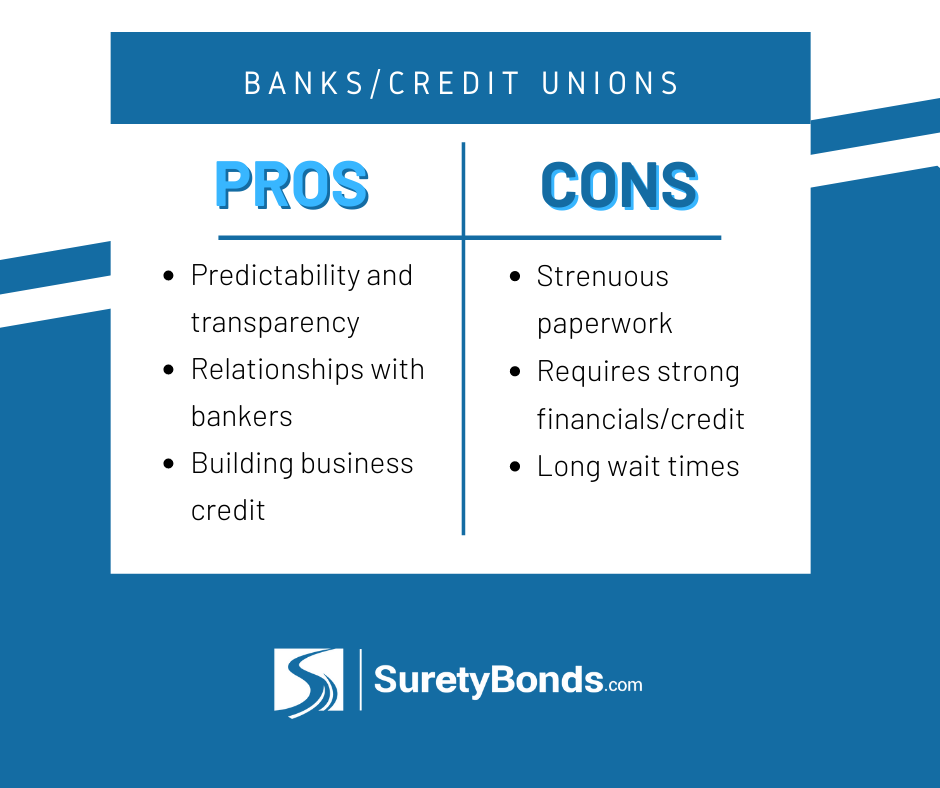

Banks and credit unions

Getting a loan from a bank is one of the most traditional ways to fund a small business. Banks, as Nav notes, are the largest business lending institutions and often offer lower-cost financing options than you would get through credit cards or short-term loans. Funding your business through established institutions such as banks also means that, while the paperwork might be onerous, the terms of your loan should be transparent and predictable; you may even build relationships with your bank that will benefit your business and assist you with questions or concerns. You will additionally be able to use your business loan for many things, such as everyday operations, startup costs, and technology to help you stay ahead of the competition.

The well-worn path of banks and business loans is not for everyone, however. If you have poor credit or are in a rush to get your business funded, pursuing a business loan from a bank may not be the best option for you because banks require credentials such as high credit scores and can take months to process applications. Banks often additionally prefer to make larger loans, so credit unions may be a strong alternative with better interest rates if you don’t need a sizable amount of funding. Recently, bank loan approval rates have fallen, with only those with strong credit and financials being approved. Ryan Nieman continues with insights on bank loans in times of uncertainty:

“Funding was one obstacle… that kept me on my toes throughout the entrepreneurial process. Banks are already hesitant in lending to first-time business owners, and the pandemic made it even worse. Uncertainty was high at that time, and lenders were concerned my start-up would not be able to survive the pandemic.”

Local entrepreneurial organizations

Entrepreneur organizations have proliferated with small businesses and can help your company with networking, funding, and other elements necessary for your business’s growth. Smart Hustle has compiled a list of the top organizations around the world, including large national operations such as the Small Business Administration. Some entrepreneurs recalled in the SuretyBonds.com 2021 Entrepreneurial Insights Survey that these have been providing helpful assistance programs, especially during recent times of relative economic uncertainty. Other organizations, like The Entrepreneurs Organization (EO), chambers of commerce, and Dynamite Circle have more to offer locally, sponsoring networking events and other support programs.

Researching your area can also help to uncover local hidden gems that will support your business. In mid-Missouri, for example, the Regional Economic Development Incorporation (REDI) attracts, expands, and grows business development through a variety of incentives, resources, and events to create a better economic future for the region.

Crowdfunding

A more novel funding avenue, crowdfunding has increased in popularity in the last decade or so, allowing entrepreneurs to sidestep traditional routes and find funding by giving their pitch not to angel investors or banks, but straight to the public.

The most obvious perk of a crowdfunding campaign is that there is not much risk involved. You may be able to get a feel for the market that will decide whether or not your business is worth investing in. Your success would then speak strongly to the legitimacy and merit of your idea, and you will have a pre-built community with an interest in your product as you move forward. In this area, crowdfunding might have an edge on bootstrapping. Instead of relying on your own savings or the money of those who want to see you succeed, you can subject your idea to some of the market forces that will decide its success before you’re in too deep financially. Compare this also to capital investments; with crowdfunding, you may give rewards back to those who got you off the ground, but your equity and control in your company is safe.

Still, crowdfunding efforts do take time and money, and success is far from guaranteed. Even if your idea doesn’t have to be completely off the ground, crowdfunding campaigns require effective marketing and prototypes that will large investments of your effort and time. Many popular platforms for crowdfunding additionally require fees and take a cut of the funding that successful campaigns raise. There are plenty of crowdfunding success stories, but also many campaigns that fail. As always, your business type and your goals should be factored into funding decisions; Fundbox notes that you may be more inclined to crowdfund with consumer-facing products like card games or clothing than if you were trying to jump-start your catering business.

Conclusion: Small business funding is not one-size-fits-all

At the end of the day, the decision of how you fund your small business should depend on where your business is at in its development and how you’d like to see it grow. If you have the months of time it takes to secure venture capital funding or a loan from a bank, courting investors or applying for bank loans may be right for you. If you need funding quickly, avenues such as bootstrapping or crowdfunding may be more attractive. You should also keep in mind whether or not you are willing to exchange equity in your company for funding and expertise. If you or your business need a surety bond to get growing, call 1 (800) 308-4358 to talk to a SuretyBonds.com expert or get a free, no-obligation quote.