If you are an entrepreneur, you know that no matter the industry, the legislative and regulatory environment is constantly evolving. Regulatory developments can be very difficult to keep up with, but they can mean the difference between being in compliance and being in the red.

While you may initially see this as a burden, you’ll quickly realize that keeping up with regulations allows you to make better decisions while running your business. An upcoming rule change offers the possibility of making a significant impact on your business, and you can benefit from knowing about it immediately so you can shift in a timely manner.

But if the benefits of following legislation and guidelines aren’t enough to convince you, the possible consequences certainly will. An entrepreneur failing to comply could risk leaving the business open to lawsuits from any wronged parties, audits from government agencies, or large fines — even retroactive ones. All of these could lead to bankruptcy or losing an operating license, especially among small business owners.

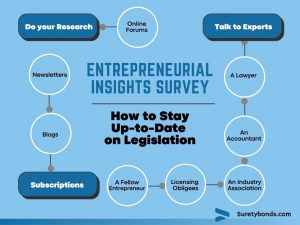

SuretyBonds.com recently published its 2021 Entrepreneurial Insights Survey Report, which detailed what motivates small business owners and the resources that have been most helpful to them in overcoming obstacles. Changing legislation and regulatory guidelines were noted by respondents as highly challenging aspects to overcome, so we’ll explore the ways these entrepreneurs can stay up-to-date on legislation and regulations in their industry.

Do Your Research

Doing your research is known to pay off. While this may seem obvious, doing your own research prior to entering your industry is a step many forget.

“If I had been aware about the legalities earlier, I would have easily identified the gaps and would have acted accordingly,” says Josefin Bjorklund, founder of Topp Casino Bonus.

Particularly if your questions are direct and can be answered with a simple online search, entrepreneurs should utilize this before reaching out to additional experts. Rachel Green, founder of Green Gutter Guys, familiarized herself with credible legal resources and says:

“Knowing the question you want to answer comes first, and many trusted online sources can provide a simple overview or punch list that you can elect to delve deeper into and further research.”

However, manually doing your own research may not always be the most efficient for each person — and there are multiple ways to know if something comes up in between!

Subscribe to or Follow Blogs and Newsletters

One of those ways is to subscribe to an industry newsletter or follow a relevant blog. By subscribing to industry newsletters, you can have regulatory updates delivered directly to your inbox. There are hundreds, even thousands, of email newsletters for free that can help entrepreneurs learn how to grow their business and maintain it. For contractors specifically, The Associated General Contractors has up to 17 different newsletters specific to what each business needs, including the impacts of construction law, changing regulatory affairs, and how entrepreneurs can implement these changes.

Entrepreneurs can also research and read similar content regarding legislation from their surety company. Why the surety? SuretyBonds.com’s blog, for example, consistently publishes blog posts surrounding the changes in legislation and regulations for the wide variety of industries it serves. From Alabama auto dealers to California tax preparers, our blog touches on the legislative changes they need to know about and when they take effect.

Keep Experts on Retainer

Many entrepreneurs entering an industry may not be entirely equipped with all the necessary knowledge immediately. This is why Forbes advises entrepreneurs who are navigating crucial decisions and paths in their industry to speak to a professional for support. Professionals in one’s specific industry can provide advice like choosing the right site, lining up financial resources, ensuring adherence to government rules and regulations, or even finding the right manpower. Here are some credible sources who can be utilized for their expert advice:

Lawyers

By hiring an attorney, a business owner can be educated on the various legalities and situations they encounter throughout the course of their day-to-day business. An entire operation becomes more efficient, organized, and compliant as a result.

“My business had undergone numerous changes due to legal jargons. Hiring an attorney helped me obtain various necessary permits for the smooth workflow of my business,” says Josefin Bjorklund, founder of Topp Casino Bonus.

Deciding on the type of lawyer who is right for you depends entirely on what your business does and how it’s organized. There are infinite types of specialty attorneys that hold industry-specific thresholds of information ranging from real estate to tax to entertainment attorneys.

Entertainment attorneys, for example, are niche and represent comedy, music, film, and electronic media. Different from tax attorneys resolving tax matters and legalities, entertainment lawyers offer protection of their clients’ intellectual property rights, representation of them in court over disputes, negotiation of contracts, maximization of earnings, and management of taxes, among other tasks.

Accountants

An accountant is one of the most common experts that entrepreneurs reach out for help. In fact, Mohamed Sehwail, founder of Full Session, noted that a main purpose in briefing researching was in preparations of obtaining an accountant:

“I always knew I would outsource accounting and finance, but I still needed to have a good understanding of the basics in order to have fruitful discussions with my accountant. The same applies to legal matters, administration, marketing, etc.”

Accountants help in creating business budgets and determine the business health of an enterprise; according to Forbes, accounting is crucial for making predictions on the future. When hiring an accountant to analyze your finances, accountants can also adjust housekeeping around legislation as they are equipped with knowledge of legalities when doing so.

But, similar to obtaining the right lawyer, the same goes for complex industries like contracting. Construction accountants have the additional expertise of what construction companies endure: retention, job costing, change orders, progress billings, customer deposits, and other anomalies. From paying taxes to managing payroll, accountants can explore the ways new legislation and regulations could risk a business’s performance or compliance. If there are any changes in the construction industry that would affect financial statements, your specialty accountant would be on task and know.

Licensing Obligees

Another way to stay up-to-date about regulatory changes in a business’s industry is to build a relationship with local, state, and/or federal regulators. These official experts are the first to know when a new rule is enacted or likely to come into play. For example, entrepreneurs who have a motor vehicle dealership in Missouri could contact the Missouri Department of Revenue. Because the department issues dealer licenses, it is the one that makes eligibility determinations and establishes the legal guidelines to get said license.

Although you can speak to someone in the office, these departments offer resources relating to the state legislature to look into on your own. However, if an entrepreneur is communicating with regulators on a regular basis, they’ll be more likely to hear about changes right away in a less complicated or confusing manner.

Industry Associations

Lastly, joining a professional association is a helpful way to stay updated in your field. These industry associations host seminars, courses, and educational events to help entrepreneurs keep up with the latest developments. Once an entrepreneur finds their association, the business owner can receive firsthand accounts of changing expectations.

For example, the National Association of Realtors (NAR) is a membership-based association for real estate agents that offers networking, industry trend tracking, business growth resources, and other essential tools for success. NAR advocates every day for federal, state, and local legislation an policy initiatives that protect members and the public.

In addition to their own websites, many regulatory agencies maintain accounts on social media platforms like Twitter, Facebook, and LinkedIn. On these platforms, posts on their activities, as well as relevant policy updates, are often shared. If you already use social media regularly, following these accounts is an easy way to stay on top of regulatory changes.

Fellow Entrepreneurs

Keeping in touch with other professionals in your industry or community is more than simply building your network of allies. Doing so can also help you stay ahead of regulatory changes. For example, a fellow entrepreneur in your industry might attend a conference or read an article and hear about a new regulation that you might otherwise have missed. By staying in touch and asking for help, you’ll benefit from their knowledge of upcoming regulatory changes.

Legislative and regulatory guidelines will evolve throughout your entrepreneurial journey. Regardless of the industry you work in, staying on top of these changes will better your business and prevent fines and other unnecessary troubles. Utilizing even one or two resources can make a big impact on the success of your business — and its bottom line.