How to Get a Mortgage Broker License in Arizona

This guide is for informational purposes only. SuretyBonds.com does not regulate or manage mortgage broker licenses in Arizona. Contact the Department of Financial Institutions for the latest official requirements.

How to Become a Mortgage Broker in Arizona

The Department of Insurance and Financial Institutions (DIFI) regulates Arizona mortgage broker licenses. Under Arizona Revised Statutes § 6-903, companies that negotiate or place residential mortgage loans must be licensed as brokerages.

To apply for a license, you’ll need to pass an exam and file a surety bond. Continue reading for step-by-step application instructions, renewal information and a total cost breakdown.

Which Mortgage License Do I Need?

In Arizona, your mortgage license type depends on how you or your company handles mortgage loans. The DIFI issues the following licenses:

- Mortgage Broker: Helps borrowers find, negotiate or place residential mortgage loans with lenders.

- Commercial Mortgage Broker: Handles commercial property loans for businesses or investors.

- Mortgage Banker: Makes, sells, services or funds mortgage loans using their own money or company capital on Arizona property.

- Mortgage Loan Originator: Takes mortgage applications or negotiates loan terms for pay on behalf of a mortgage broker or banker.

The only individual license is the mortgage loan originator (MLO) license, the broker and banker licenses are only available for companies.

SuretyBonds.com issues Arizona mortgage professional bonds for MLOs, bankers and brokers.

What Is a Responsible Individual?

The DIFI doesn’t issue individual Arizona mortgage broker licenses. Instead, each company must designate a Responsible Individual (RI) who will complete all licensing requirements and actively manage the company’s affairs. As the RI, you represent the company’s license.

If you are a sole proprietor, you are automatically the RI. However, LCs and corporations can select any employee who qualifies.

To apply for a license, the responsible individual must meet the following requirements:

- Be an Arizona resident

- Be a W2 employee of the company (not an independent contractor)

- Have 3+ years’ experience as a mortgage broker or equivalent lending experience in a related business in the past five years

- Complete a 24-hour prelicensing course within three years of applying

- Pass the Arizona Mortgage Broker Test

How Do I Get an Arizona Mortgage Broker License in Arizona?

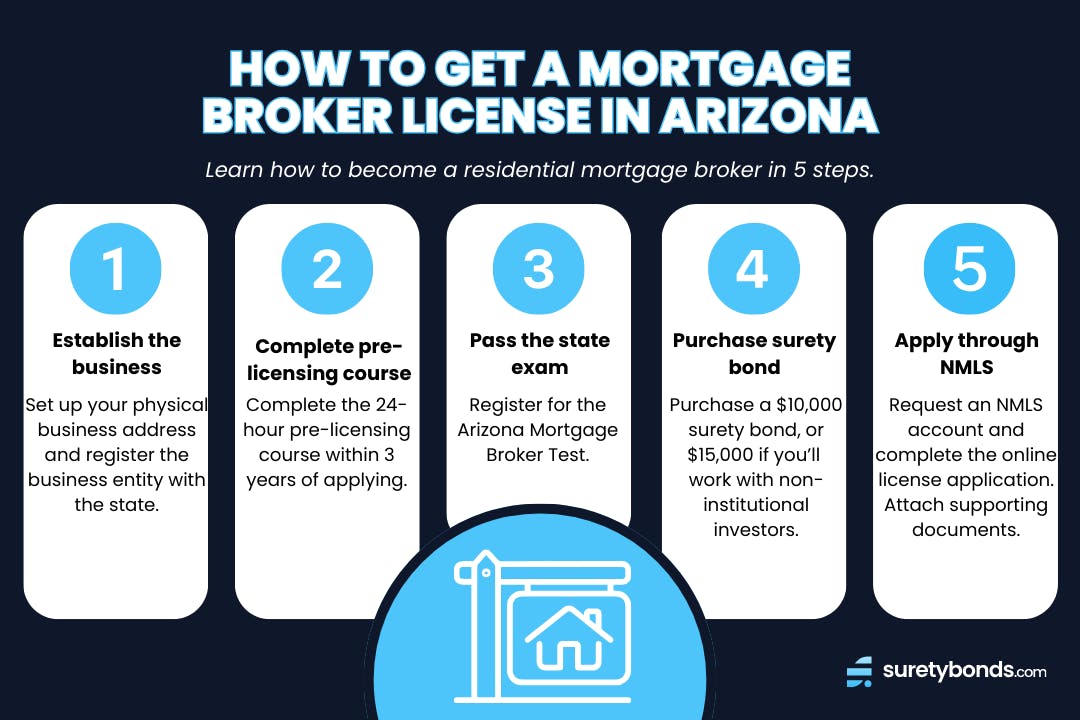

To apply for an Arizona residential mortgage broker license as the Responsible Individual, follow these five steps.

Step 1: Establish the business

Your company must have at least one physical place of business in Arizona. This can be a residential or commercial property. You’ll submit a separate branch application for any additional locations.

For sole proprietors and partnerships, be sure to register your trade name with the Arizona Secretary of State. LLCs and corporations must file with the Arizona Corporation Commission.

Step 2: Complete pre-licensing education

Next, complete the 24-hour prelicensing course through OnCourse Learning no more than three years before applying. The class is only offered live in an in-person classroom setting.

Step 3: Pass the mortgage broker exam

Then, you can register for the Arizona Mortgage Broker Test. The exam costs $42 and can be taken in-person or proctored remotely. You’ll need to arrive at the testing center at least 30 minutes before your exam time to be admitted.

Pass with a minimum 70% score to continue the application process.

Step 4: Purchase a surety bond

After passing the exam, purchase a surety bond in the required amount based on your business model:

- $10,000 Bond: Brokers who only work with institutional investors*

- $15,000 Bond: Brokers who accept investment funds from private individuals, companies or any other non-institutional source

You’ll file this bond along with your license application as proof of financial security.

*"Institutional investors" are large, regulated financial entities, such as state or national banks, savings banks, credit unions, federal agencies and insurance companies.

Step 5: Apply through NMLS

Finally, request an NMLS Account so you can start the online mortgage broker license application. Once approved, upload the following documents to NMLS:

- Criminal background check authorization

- List of employment history

- Articles of Incorporation

- Surety bond form

- Documentation of Citizenship or Alien Status (sole proprietors only)

- Business plan, including marketing strategies and operating structure

- Management chart displaying divisions, officers, managers and internal audit structure

- Organizational chart of percentages of ownership

- Personal Finance Statement (sole proprietors only)

- Unaudited recent financial statements

Once you complete the application, pay all fees through NMLS. After reviewing the materials, the DIFI will contact you regarding your license status.

How to Renew Your Mortgage Broker License

As the Responsible Individual, you must complete 12 hours of continuing education (CE) relating to the mortgage industry before renewal each year. You’ll complete the renewal application and pay the annual fee via NMLS.

Your license expiration depends on your original application date:

- January–October Applicants: Your license is valid through December 31 of the current year.

- November–December Applicants: If you submit your renewal in November or December, your license remains valid through December 31 of the following year.

How Much Does It Cost to Become a Residential Mortgage Broker in Arizona?

You can expect to pay around $1,600 to get an Arizona mortgage broker license. The license fee will be prorated based on when you submit your application:

- January, February, March: $250.00 fee

- April, May, June: $187.50 fee

- July, August, September: $125.00 fee

- October: $62.50 fee

- November, December: $312.50 fee

In addition to the license fee, you can expect the following expenses throughout the licensing process:

- Prelicensing course: Typically $699

- Application fee: $500

- Surety bond: Typically $100–$150 for $10,000 coverage or $112–$200 for $15,000 coverage*

- Processing fee: $120

- Criminal background check: $36.25 per person

- Test fee: $42

*This reflects typical SuretyBonds.com mortgage broker bond rates for a one-year term.

What’s the Difference Between a Mortgage Broker and a Commercial Mortgage Broker?

Standard mortgage brokers focus on residential mortgages, while commercial mortgage brokers are limited to commercial property.

Commercial brokers have similar license requirements, including a Responsible Individual and continuing education. The surety bond amount is also the same. However, there is no exam or prelicensing education.

How Difficult is the Mortgage Exam?

All mortgage brokers must pass the Arizona Mortgage Broker Test with a minimum score of 70%. While the exam can be difficult, the Arizona Mortgage Broker Test Handbook details the concepts you need to know and can help guide your studying.

You’ll have three hours to answer 100 multiple-choice questions. The exam covers seven topics distributed as follows:

- Obligations between principal and agent (7%)

- Canons of business and ethics (7%)

- Mortgage broker statutes and rules (48%)

- Math for mortgage brokers (5%)

- Principles of real estate (11%) Real estate lending principles

- Mortgage deed of trusts and security agreements (7%)

- Federal regulations (15%)

The test is held on the first Thursday of every month at the DIFI office. You’ll receive your test results via email within 30 days.

How Quickly Can I Become an Arizona Mortgage Broker?

To be a responsible individual, you need to have at least 3 years of experience, completed in the past five years. AZ Rev Stat § 6-903 defines qualifying experience as work performed as “a mortgage broker, a loan originator, or in an equivalent lending role.”

If you don’t have a full three years of direct lending or broker experience, you may still be eligible. The DIFI allows certain related professions to count toward the requirement at a fractional rate. For example, three months of experience as an attorney counts as two months of credit toward your license. Eligible careers include:

- Attorney licensed in another state

- Paralegal with experience in real estate matters

- Mortgage broker or mortgage banker (unlicensed) in another state

- Real estate broker

- Escrow or title officer

- Trust or title company officer

Even when using related experience, you must have at least one full year of direct mortgage lending experience. Refer to AZ Admin. Code R20-4-906 for the exact credit ratios.

What Services Can Employees Perform Under the RI?

The DIFI doesn’t issue individual broker licenses. Instead, the company holds the license, and the Responsible Individual (RI) ensures all licensing requirements are met.

Since employees aren’t individually licensed, they can assist with loan applications, documentation and support tasks. However, they cannot independently negotiate or place loans for compensation.

Last Updated: December 19, 2025