There’s a lot of misinformation about what a surety bond does and the bonding process. We’re debunking common surety bond myths so consumers and professionals can make informed decisions.

12 Common Misconceptions About Surety Bonds

1. Surety Bonds Are Insurance.

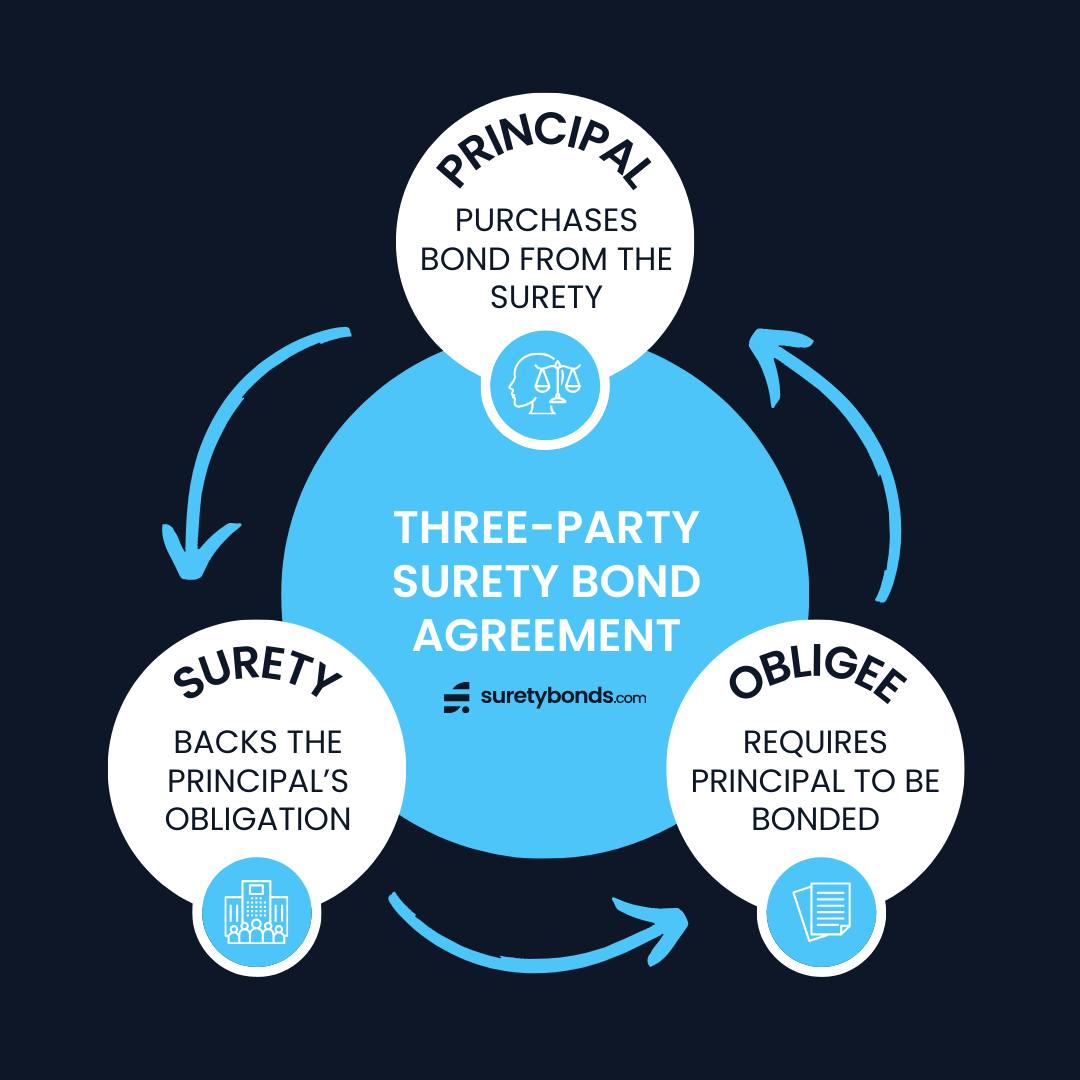

Surety bonds aren’t insurance. Insurance protects the purchaser from liability, but a bond puts the purchaser at liability — meaning they should only be bonded when required. A surety bond is a three-party agreement issued by the surety guaranteeing that the principal (party needing the bond) will complete an obligation to the obligee (party requiring the bond).

Visit our Surety Bond vs Insurance page for more information.

2. Surety Bonds Protect the Bondholder.

Surety bonds don’t protect the person purchasing the bond. Instead, a bond financially protects the obligee by guaranteeing the principal will comply with the bond contract and meet performance expectations.

3. Surety Bonds Are Necessary to Establish a Business.

You can establish a business without a surety bond. In fact, this is often a prerequisite for getting bonded. Bonds usually become a requirement when applying for a business license or permit.

Visit our license guide library for more information about specific license types.

4. Surety Bonds Are Trust Accounts.

Surety bonds aren’t trust accounts. A trust account is a financial account opened by an individual but managed by a designated trustee with agreed-upon terms and allows refunds if the business shuts down. Surety bonds don’t offer refunds during a business closure since they are premium-based.

If you need to file a trustee surety bond, read our Court Bond Guide to learn more.

5. Surety Agencies Determine Bond Requirements.

Surety agencies can only quote and issue bonds based on the information the obligee provides to clients. The client should know their required bond amount and specific bond type, or verify with the obligee before applying. If you have questions, our surety experts are happy to help.

6. Surety Bonds Are Optional.

Surety bonds are usually not optional. If the obligee has a bond requirement, it most likely means it’s mandatory. The principal should contact the obligee or check local licensing laws to verify.

7. Surety Bonds Can Be Transferred Between Locations.

Surety bonds are not transferable because most bonds are set at the state, city or county level and each jurisdiction has unique requirements. Licensed professionals working in multiple locations must check local requirements to determine whether they need to file additional bonds.

8. All Surety Bonds Cost the Same.

Surety bond prices vary across industries, locations and coverage amounts. Bonds can require more protection and higher premiums depending on the risk.

Some bonds are a flat rate and require no underwriting at all. Underwritten bonds cost between 1% to 15% of the bond amount.

Use our surety bond cost calculator to estimate your premium.

9. Bond Premiums Are Paid in Monthly Installments.

Surety bonds are not paid in monthly installments — they are paid for in full and cover the bond’s whole term. For example, a two-year term surety bond is paid for upfront in one payment.

10. Surety Bonds Are Refundable.

Since they are legal documents, surety bonds are typically not refundable once issued, regardless of time in effect. One exception is if there’s collateral, which is an uncommon occurrence.

11. Surety Bonds Hurt Credit Scores.

Surety bonds are paid once upfront, so they won’t hurt the principal's credit score. Plus, surety underwriters typically only do a soft credit pull to set premiums and verify if the individual can reimburse the surety for potential claims.

Worried about your credit score? Check out our Bad Credit Bonding Program.

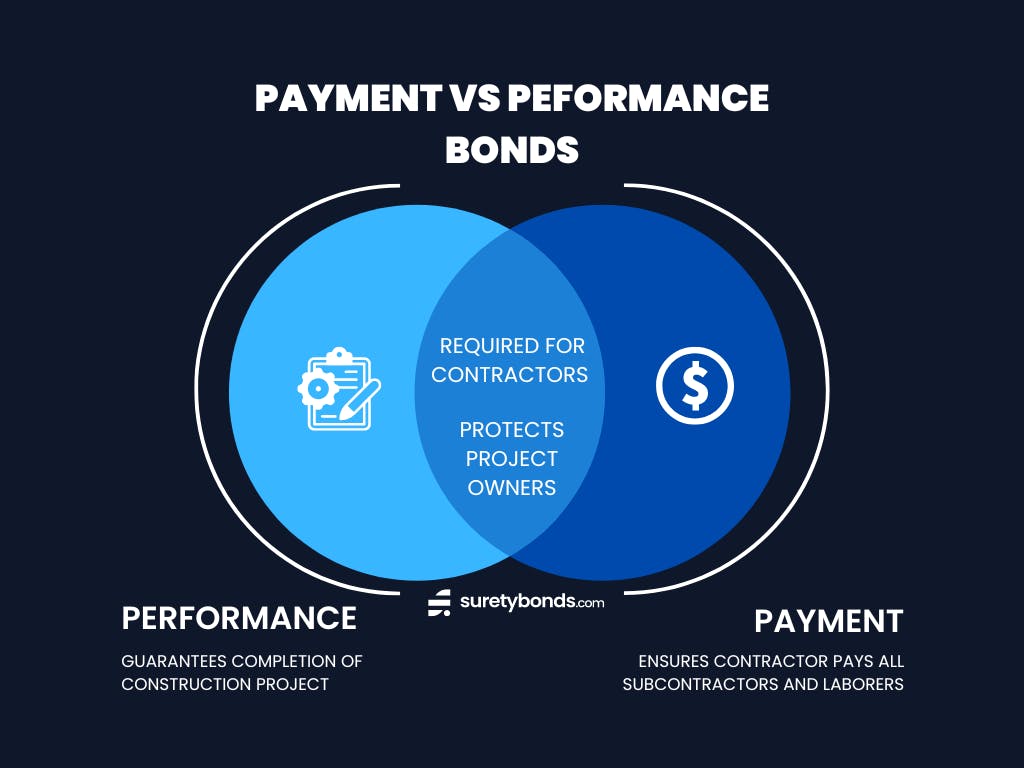

12. Performance and Payment Bonds Are the Same.

Sureties often issue performance bonds at the same time as payment bonds, but they serve different purposes. Performance bonds guarantee project completion by a contractor while a payment bond guarantees payment to subcontractors, laborers or suppliers on a job.