Many new businesses and contractors need to be bonded, licensed and insured. Business insurance and licensing is relatively straightforward, but what does it mean to be bonded?

What Does It Mean for a Company to Be Bonded?

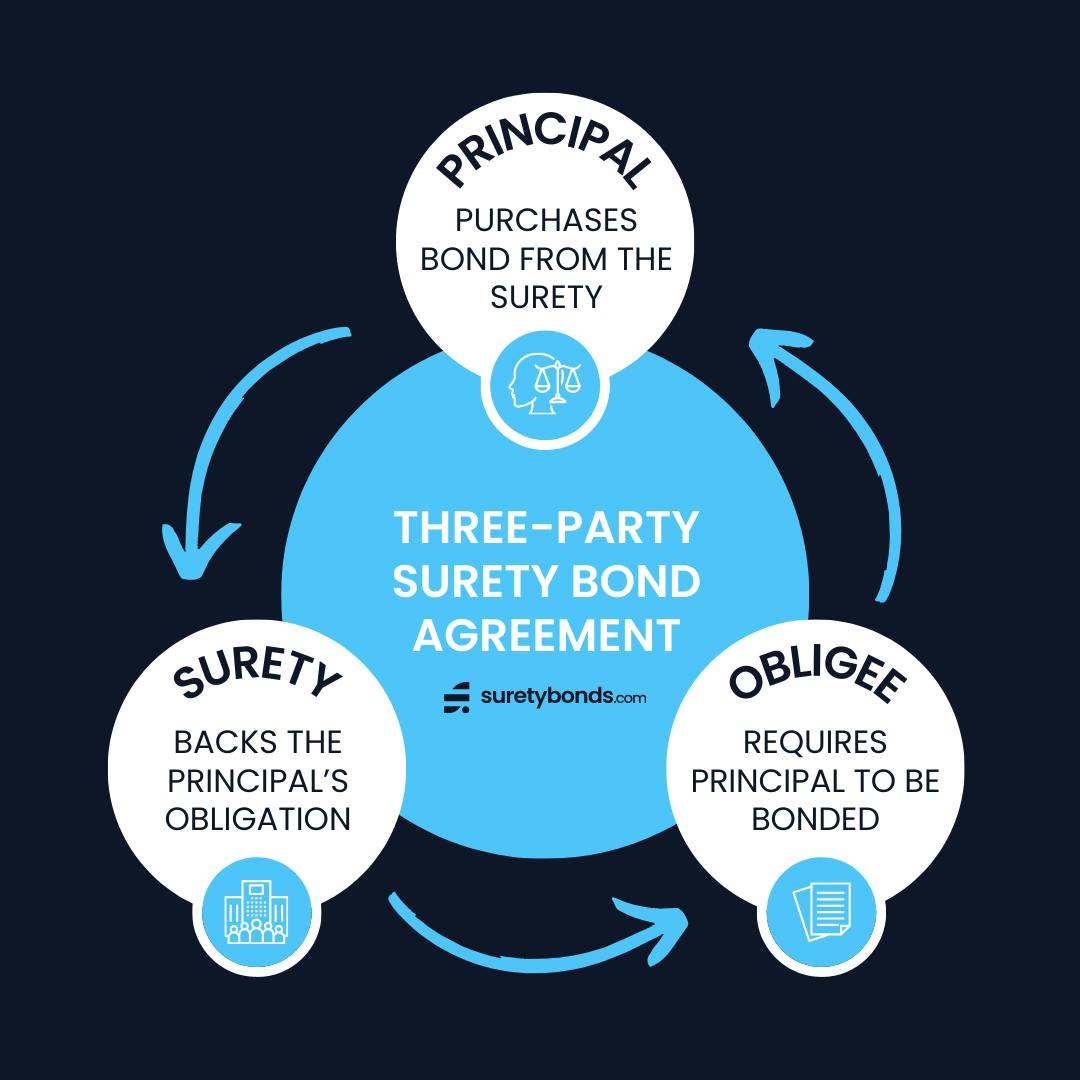

In more technical terms, being bonded means a company has entered a mutual contract between three parties:

- The obligee that requires the the bond (usually a government entity)

- The principal who purchases the bond from a surety company and files it with the obligee

- The surety company who issues the bond and financially backs the principal’s obligation

For example, the California Department of Motor Vehicles (DMV) requires auto dealers in California to purchase a surety bond when getting a business license. In this case, the California DMV is the obligee and the auto dealer is the principal.

What Are the Benefits of Being Bonded, Licensed and Insured?

The benefits of being licensed, bonded and insured include the ability to:

- Operate legally

- Increase consumer trust

- Protect the business financially

- Bid for larger contracts

Being bonded specifically reassures customers that a business stands behind its promises—and if they don’t, consumers will be protected from financial loss.

What’s the Difference Between Being Bonded vs Insured?

Many businesses need to be both bonded and insured. This is because surety bonds serve a different purpose than insurance policies. Insurance protects a business while a surety bond protects its customers.

| Surety Bond | Insurance Policy | |

|---|---|---|

Number of Parties | 3 — Principal, Obligee, Surety Provider | 2 — Policyholder, Insurance Provider |

Protection | Protects customers/general public | Protects the policyholder |

Purpose | Acts as a risk-mitigation contract | Acts as a risk-transfer tool |

Loss Expectations | Financial loss is not expected | Exposure to risk is expected |

Claims Repayment | Principal is responsible for refunding the surety for claims | Policyholders do not need to reimburse the provider for claims |

Who Should Be Bonded?

Numerous industries require surety bonds for consumer protection, and some business owners buy them by choice. Common business types and professions that require bonds include:

- Auto dealers

- Public notaries

- Mortgage professionals

- General contractors

- Insurance brokers

- Cleaning services

- Travel agencies

Surety bonds can also be required for certain individuals involved in court proceedings or appointed fiduciary duties. Lastly, bonds may be needed for individuals seeking replacement documents for lost financial instruments or missing vehicle titles.

Do I Need to Be Bonded, Insured or Both?

Government agencies often mandate bond and insurance requirements. Regulations vary by industry and area, from federal to county-level jurisdiction. Always check with your local governing agency to determine if you need to be bonded and insured.

How to Get Bonded and Insured

If you do need to be bonded and insured, follow these five easy steps:

- Determine your bond and insurance requirements

- Purchase an insurance policy from a trusted provider

- Apply for and purchase your surety bond from SuretyBonds.com

- File your bond with the obligee

- Renew coverage annually, or as needed

Apply for a free bond quote now to get your bond quickly and easily.