How Much Does a Surety Bond Cost?

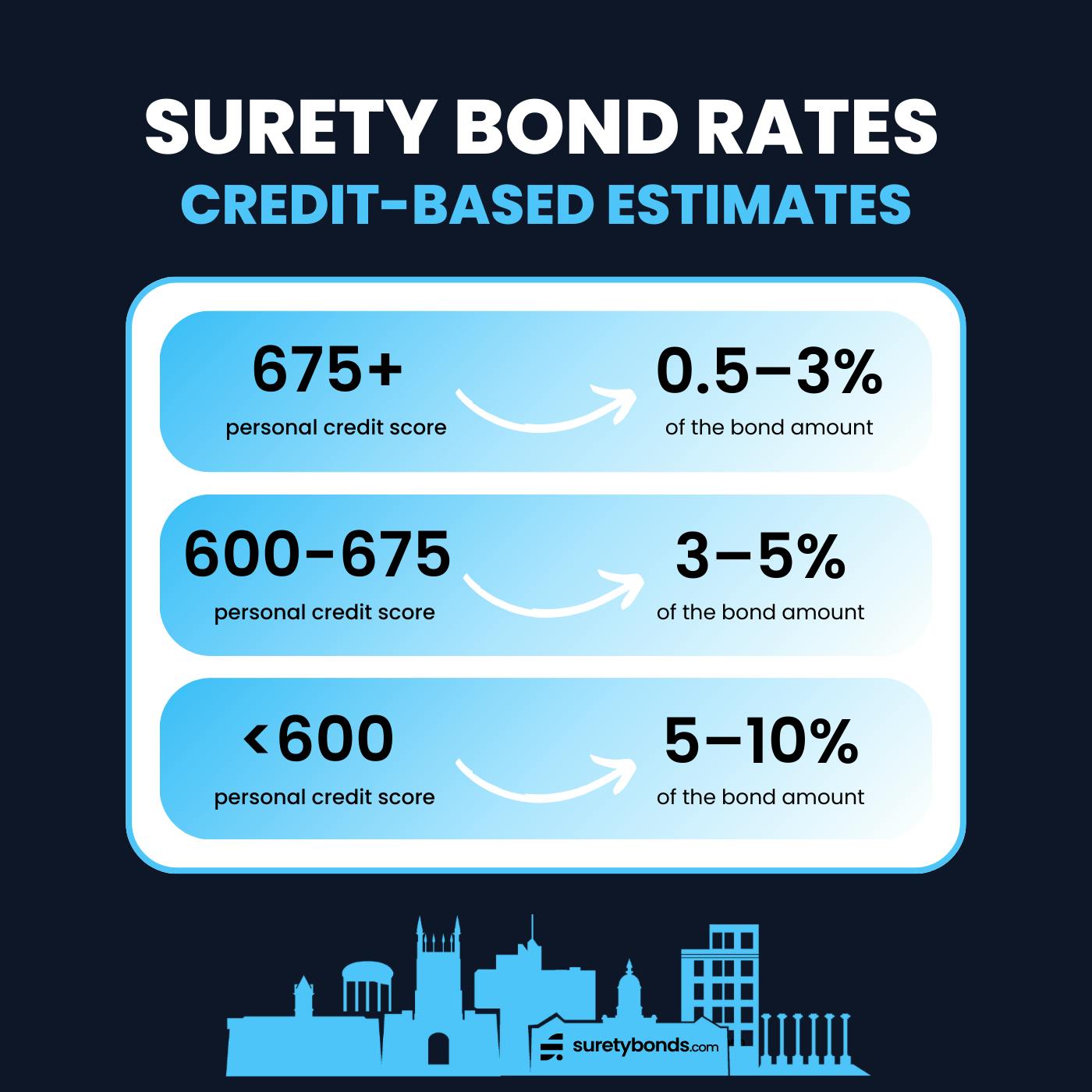

The cost of a surety bond is calculated as a small percentage of the total bond amount — typically 0.5–10%.

This means a $10,000 bond policy may cost between $50 and $1,000. For applicants with strong credit, most bond rates are 0.5–4% of the bond amount.

So, if you're told you need a $50,000 bond, you'll likely pay around $500. You would only need to pay the full coverage amount if there were claims made on the bond.

Get the best surety bond price when you choose SuretyBonds.com. We find the lowest bond rates available nationwide — no matter your circumstances.

Estimate Your Surety Bond Premium Rate

Use the table below to estimate your surety bond cost based on your credit score and the bond amount.

You can click the bond amounts to see a more detailed breakdown of surety bond rates for specific coverage amounts.

| Surety Bond Amount | Excellent Credit (675+) | Average Credit (600-675) | Poor Credit (599<) |

|---|---|---|---|

$25–$150 | $150–$250 | $250–$500 | |

$50–$300 | $300–$500 | $500–$1,000 | |

$125–$750 | $750–$1,250 | $1,250–$2,500 | |

$150–$900 | $900–$1,500 | $1,500–$3,000 | |

$250–$1,500 | $1,500–$2,500 | $2,500–$5,000 | |

$375–$2,250 | $2,250–$3,750 | $3,750–$7,500 | |

$500–$3,000 | $3,000–$5,000 | $5,000–$10,000 | |

$750–$4,500 | $4,500–$7,500 | $7,500–$15,000 | |

$2,500–$15,000 | $15,000–$25,000 | $25,000-$50,000 | |

$5,000–$30,000 | $30,000–$50,000 | $50,000–$100,000 | |

*This table provides rough bond cost estimates. Pricing fluctuates due to various factors. Apply online for an exact quote. | |||

Use our Surety Bond Cost Calculator to find a more specific estimate for the bond you need. For an exact quote, you can apply online in under two minutes or call us at 1 (800) 308-4358.

What Factors Determine My Surety Bond Cost?

Risk is the main determinant of your bond price. Lower risk means lower rates. Higher-risk bonds, such as court bonds, construction bonds and mortgage broker bonds, receive more claims and are likely to be underwritten.

If your bond requires underwriting, each person with more than a 10% ownership stake in the organization will be reviewed.

A credit report often suffices, but your underwriter might also look at additional factors like work history, industry experience and financial statements. This is especially true for high-risk bonds, such as freight broker bonds or performance bonds.

6 Factors Impacting Your Surety Bond Price

- Bond Amount: Higher coverage bonds typically have higher premiums

- Bond Type: Lower-risk bonds have lower premiums

- Credit Score: A strong credit score qualifies you for the best pricing

- Assets: Asset ownership indicates lower financial risk

- Financials: Positive financial statements can lower your quote

- Experience: Industry experience lowers risk for certain bonds

How Can I Lower My Bond Price?

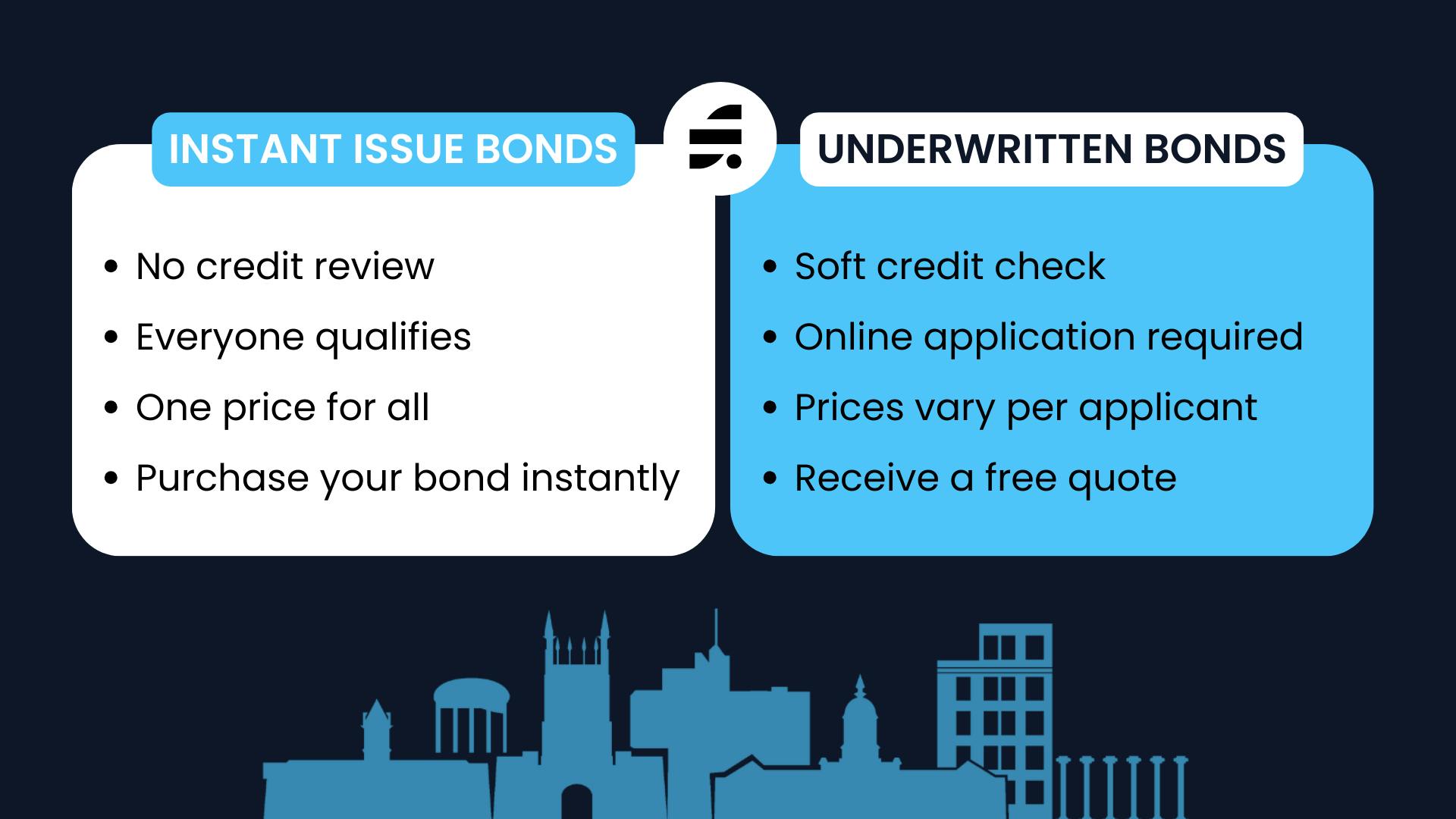

All surety bonds are priced in one of two ways:

- Instant Issue Bonds: Issued instantly to all applicants at a set price

- Underwritten Bonds: Subject to underwriting review, price varies per applicant

To get the lowest pricing for your underwritten surety bond, ensure your credit score, personal financials and business financials are in good shape.

If your premium quote is high due to poor credit, you can try strengthening your application in the following ways:

- Provide a verifiable personal financial statement or a business financial statement

- Provide a resumé demonstrating your industry experience

- Add a cosigner with stronger financial credentials to the account

Choosing the right surety bond provider can also save you money. SuretyBonds.com offers multi-year discounts for select bonds and charges zero processing fees.

Learn more about how to lower your surety bond cost.

Does the State I Live in Affect My Bond Price?

Yes, the state in which you file a bond can affect your bond amount and cost. Each state has different bonding requirements, so your residency will be a determining factor.

For instance, auto dealers in Arizona must file a $100,000 surety bond, while dealers in South Dakota only need a $25,000 bond.

Select your state below for more specific pricing information:

Why Does My Bond's Risk Affect My Rate?

A surety bond is a financial guarantee of the principal’s ability to meet the bond’s terms. When a surety provider issues a bond, the underwriter provides this guarantee. Therefore, the lower the risk, the lower the rate.

Learn more about how surety bond costs are calculated in this video:

Is the Bond Amount the Same as the Bond Cost?

No, your bond amount is not the cost of your bond.

- The coverage amount is the total security for any potential claims made against the bond.

- The bond premium is a much smaller fee you pay the surety company to issue the bond.

As you outlined below, your bond rate is a percentage of the bond amount. For example, if you need a $5,000 bond, you will likely only pay a premium of $25–$500. Similarly, a $50,000 bond would cost between $250–$5,000 and a $500,000 bond would be around $2,500–$50,000.

Does It Cost to Apply for a Bond?

No, the surety bond application is completely free. You can apply for a bond now and receive a quote within one business day — or instantly for certain bonds.

Why Do Underwriters Need to Look at My Credit Score?

Your credit score offers a clear and concise overview of your financial history, including your assets, bill payment history and debt-to-income ratio. Some bonds are also priced directly based on the bracket in which your credit score falls.

If you're curious to learn more about the process, view our explainer article on surety underwriting.

Can I Still Get a Surety Bond With Bad Credit?

Don’t let poor credit stop you from getting bonded! SuretyBonds.com approves 99% of applicants. While lower credit may result in a higher rate, our agents will ensure you get your bond at the best possible price on the market.

Learn more about our Bad Credit Surety Bonding Program.

Can I Finance My Premium?

Yes. To make our surety bonds more accessible, we offer premium financing plans that break up large upfront payments into smaller payments over time. If you qualify, you'll pay 30–40% of the total premium upfront and the remaining balance in monthly installments over the following 4–6 months.

Are Surety Bond Premiums Refundable?

Once a surety bond is issued, the premium is nonrefundable. The premium is earned by the surety company, whether or not there is any future payout against the bond.

Surety agencies are typically unable to prorate premium refunds even if a business closes before the bond term is complete.

I Know the Cost of My Bond — Now What?

Once you receive your free quote, you can get your bond quickly and easily. Simply pay for your premium through our secure online checkout or over the phone. Then, we’ll deliver your official bond documentation with an unparalleled turnaround time.

Secure | No Obligation | Takes 2 Minutes