Need a surety bond but not sure how to get one? This guide outlines the process of how to get a surety bond in four simple steps.

What Is a Surety Bond and Why Do I Need One?

Surety bonds are a contractual agreement between three parties: the principal (you), the surety (us) and the obligee (entity requiring the bond). They guarantee that you or your business will follow any laws and professional regulations and protect customers from harm.

How to Get a Surety Bond in 4 Steps

Step 1: Determine which bond you need

The bond you need will depend on your business or personal circumstances as well as your location. There are thousands of surety bond types for various permits, court proceedings, business licenses and more.

Here are the four primary bond categories:

In addition, most bond requirements are set by local jurisdictions and vary by state or even by city or county.

Step 2: Gather your application information

Once you find the bond you need, you’ll usually need to provide your official business name, address and ownership information. If you’re renewing your bond, you’ll also need to know your professional license number.

Some underwritten bond applications will require additional documentation such as:

- Credit score

- Personal financial statement

- Business financials

- Home ownership status

- Resume to demonstrate industry experience

Step 3: Purchase your bond from a surety agency

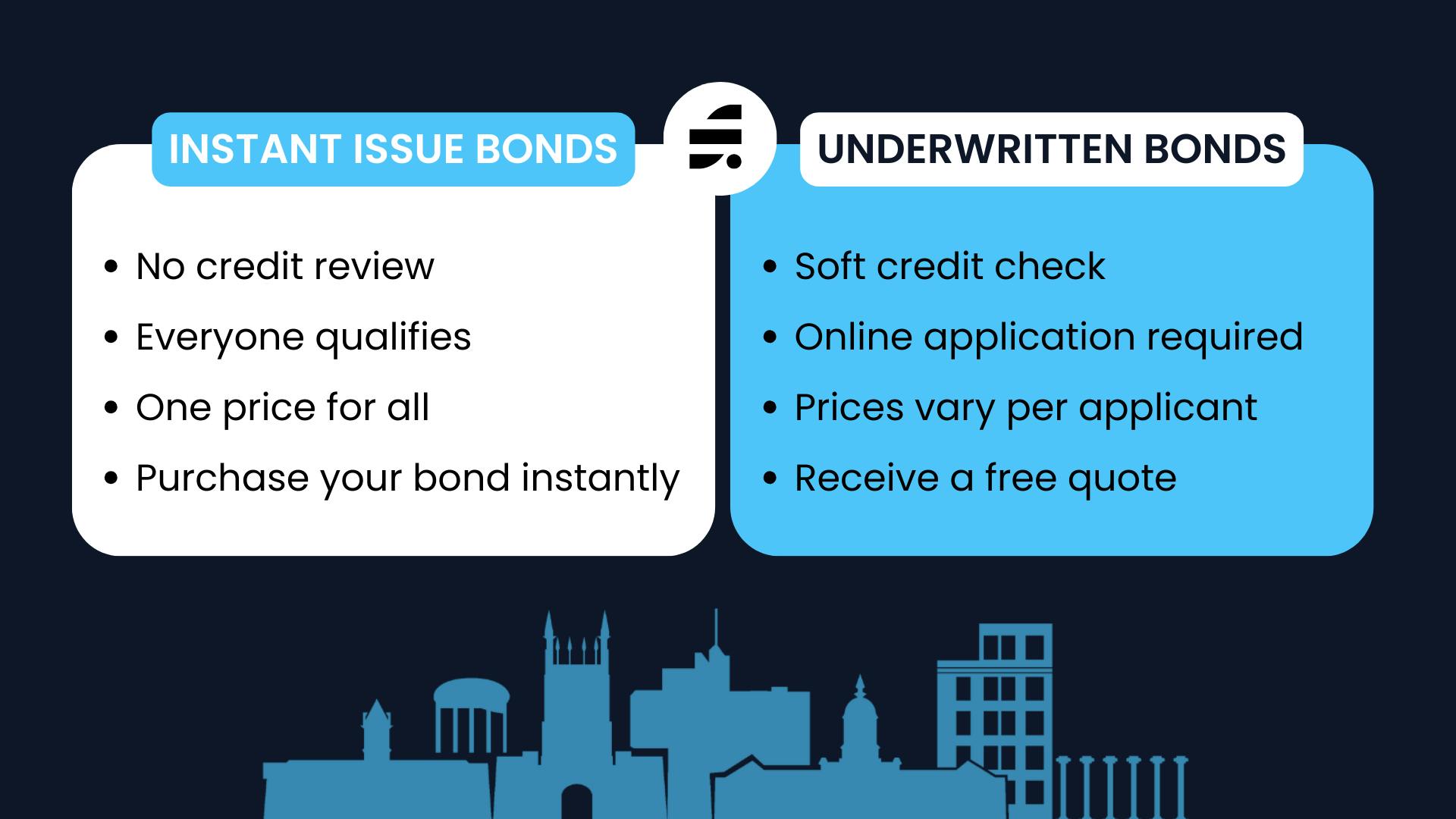

Surety agencies, like SuretyBonds.com, work directly with bond carriers to match applicants with the best available rate. You can instantly purchase some bonds online while others require an application to determine if you qualify and the premium rate you’ll pay.

- Instant Issue Bonds: These bonds require no credit review, meaning everyone qualifies and pays the same price. To purchase an instant issue bond with SuretyBonds.com, find the bond you need and click “Buy Now” to start the process.

- Underwritten Bonds: If your bond requires underwriting, you’ll need to submit a quick online application. Our experts will review your information, run a soft credit report, and provide a price quote within one business day.

Step 4: File your bond with the obligee

Your obligee will require a bond form with either a digital signature and seal or wet signatures and a raised seal from the surety provider. Our account managers will confirm if your obligee requires digital or physical delivery. Either way, you must sign your bond as the principal then submit it to the obligee to become officially bonded.

How Do I Know If I’m Eligible to Get Bonded?

You’re automatically eligible to purchase an instant issue bond regardless of your qualifications or financial history!

Eligibility and pricing for underwritten bonds depend on certain qualifications, such as credit score and financial history. Good news — we approve 99% of applicants, even if you have poor credit history. However, businesses with a history of claims or inadequate financial history may be ineligible for certain bonds.

How Long Will It Take to Receive My Bond?

You’ll receive a digital copy of your bond immediately after purchasing. If your obligee requires physical document sets, you can select three-day, next-day or overnight shipping at checkout (business days only).

How Do I Get Bonded in My State?

Each state has different bond pricing structures and coverage requirements. Select your location below to learn how to get bonded in your state:

How Long Does a Surety Bond Last?

Each surety bond has a different term, depending on the industry and state requirements. Some bonds need annual renewal, while others last up to four years. There are also “continuous until canceled” bonds, meaning the bond lasts until you are officially released by the obligee.

When your bond is close to expiration, we’ll email you renewal notices with instructions on how to renew your bond. Read more about the surety bond renewal process.